Sukanya Samriddhi Yojana has been started by the Central Government under the Beti Padhao Beti Bachao Yojana. Which is a savings plan. Through this scheme, girls born into economically weak families will not have to face financial crises in the future.

It is a small savings scheme operated for a long period. Under Sukanya Samriddhi Yojana, parents can open a savings account before their daughter turns 10 years old. In this account, the parents of the girl child can invest Rs 250 to Rs 1.50 lakh every year.

Income tax exemption is also available for investing in SSY. Apart from this, compound interest is also received at a fixed rate on the amount deposited in the savings account.

If you are also worried about your daughter’s future, then now you do not need to worry because by investing in this scheme, you can meet the future education and marriage expenses of your daughters.

Sukanya Samriddhi Yojana 2024

Sukanya Samriddhi Yojana was started by the Central Government to meet the expenses of future education, higher education, and the marriage of daughters. Which is a government saving scheme.

Under this scheme, parents or guardians can open an account in the name of a girl child below 10 years of age to meet the future needs of the daughter.

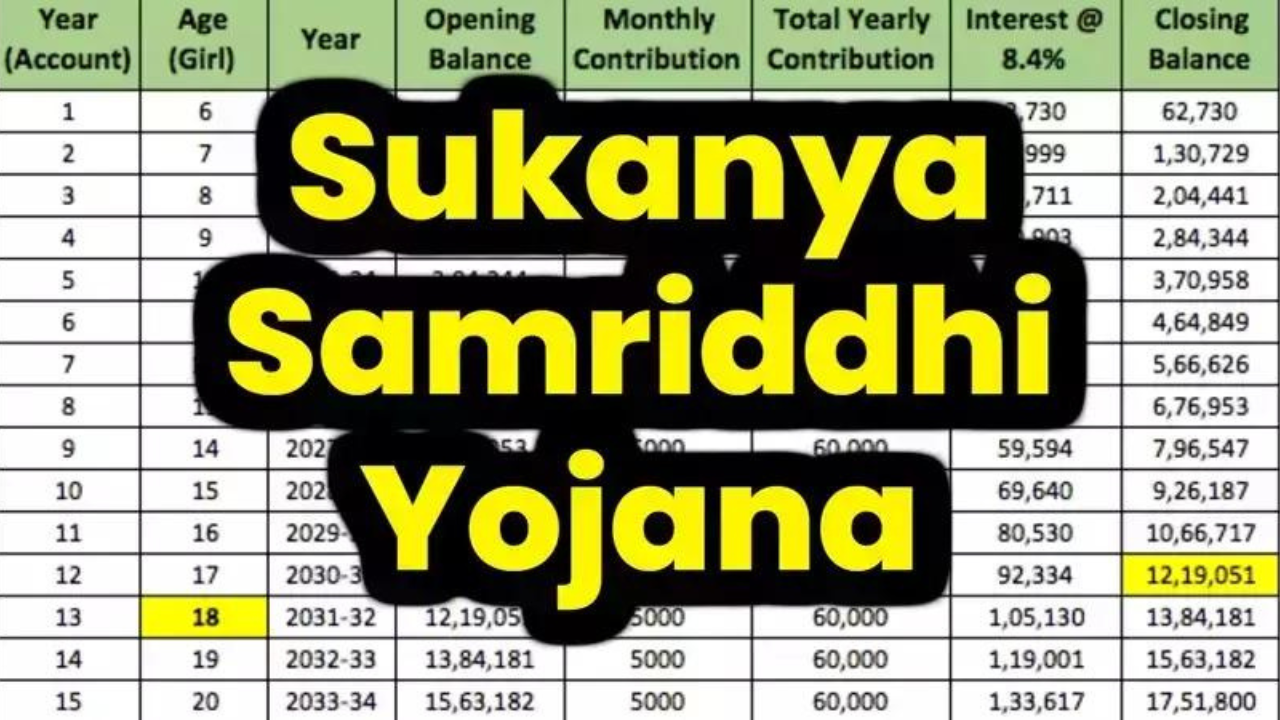

In which you can invest from a minimum of Rs 250 to a maximum of Rs 1.50 lakh per year. It is necessary to invest for at least 15 years in the account opened under Sukanya Samriddhi Yojana.

Whose maturity period is 21 years. The government is giving interest at the rate of 7.6 percent on investments made in the account for the financial year 2024-25.

Objective of Sukanya Samriddhi Yojana 2024

The main objective of launching Sukanya Samriddhi Yojana by the Central Government is to make the daughters financially strong to make their future bright and to collect funds for their marriage and education.

So that girls born into economically weak families do not have to face financial crises in the future. Under this scheme, parents or guardians can invest in the name of their daughters and they are also provided income tax exemption in the savings opened under this scheme.

Also, a big fund is collected in the name of daughters. Because it is only after the birth of daughters that parents start worrying about their future.

But through this scheme, parents and daughters will not need to worry about money when their daughters grow up. Due to this daughters will also become self-reliant and empowered.

Benefits and features of Sukanya Samriddhi Yojana 2024

- Sukanya Samriddhi Yojana has been started by Prime Minister Narendra Modi to financially strengthen the future of the country’s girls.

- Sukanya Samriddhi Yojana is a government saving scheme in which there is no market risk i.e. guaranteed returns.

- Under this scheme, parents or any family member can open an account in the name of girls below 10 years of age.

- Under the Sukanya Samriddhi Yojana, an account can be opened for an adopted girl i.e. adopted daughter.

- Only two daughters of the family will get benefits under this scheme.

- The investor can invest under this scheme according to his financial condition.

- Under Sukanya Samriddhi Yojana, investments can be made up to Rs 250 and a maximum of Rs 1 lakh.

- If needed, the account can be transferred from one post office to another or from one bank to another.