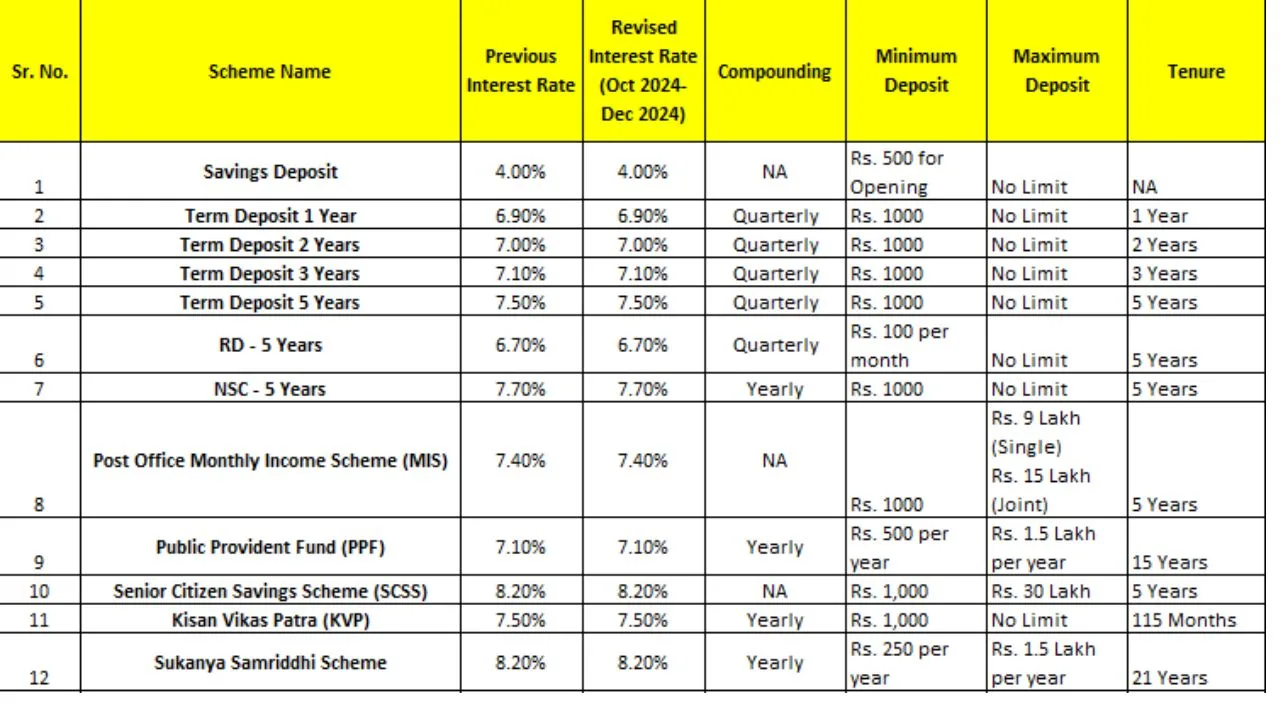

There was a time when people did not have many options for safe and fixed-return investments, but now times have changed significantly. Today, people of all classes in the country have many investment options available. The Post Office is now enthusiastically running many types of investment schemes.

Recently, data was published showing that in the savings arena, the Post Office offers more effective interest than other banks. Interestingly, the Post Office surpasses SBI (State Bank of India) in this regard. So, in this article, we will describe a special scheme introduced by the Post Office where you can get more benefits than from SBI.

Post Office Offers Higher Interest Rates Than SBI

The Post Office has been steadily gaining popularity among investors due to its competitive interest rates, which often surpass those offered by major banks. Currently, the Post Office is providing a 1% higher interest rate on its 5-year Fixed Deposit (FD) scheme compared to the State Bank of India (SBI).

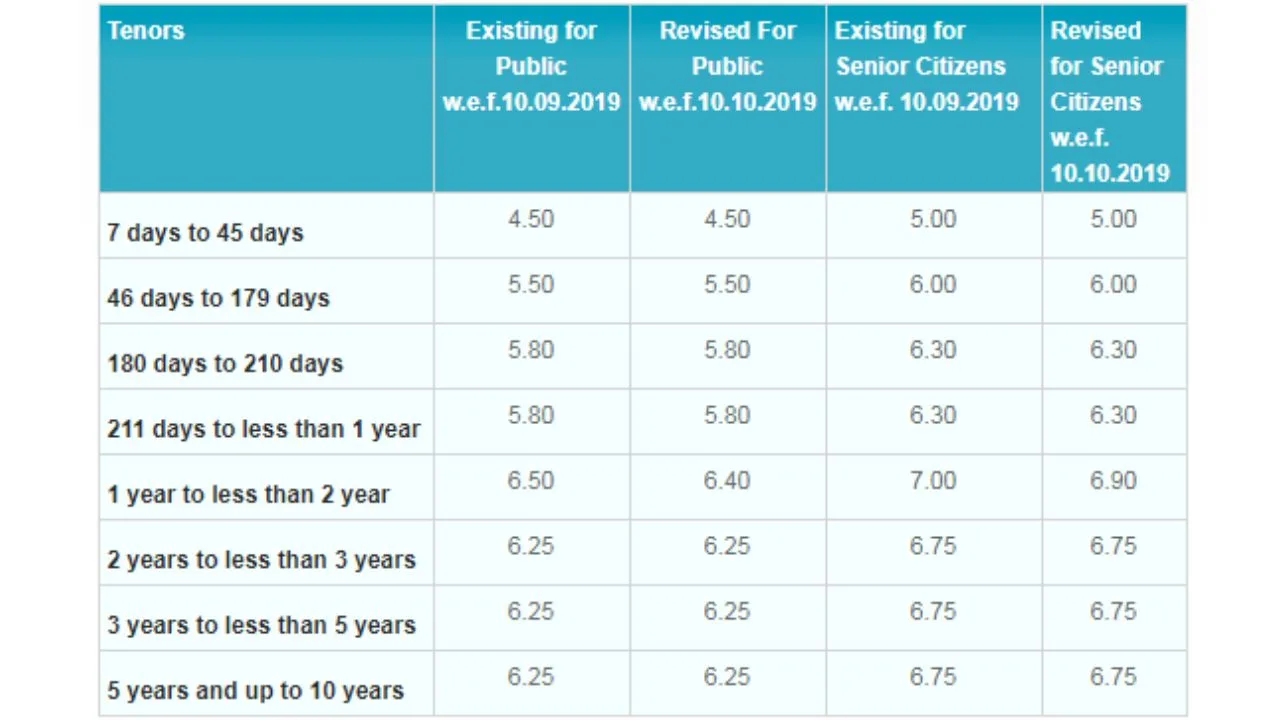

SBI’s Interest Rates

The country’s largest government bank – State Bank of India i.e. SBI is offering 6.5 per cent interest to its customers on a 5-year FD i.e. fixed deposit. SBI is offering 7.5 per cent interest to senior citizens on a 5-year FD scheme.

Post Office’s Advantageous TD Scheme

On the other hand, the post office is offering 7.5 per cent interest to all its customers on a 5-year TD i.e. time deposit, no matter what your age is. Let us tell you that the TD scheme of the post office is similar to the FD scheme run by banks. Like FD, in TD also investors get fixed and guaranteed returns after a fixed time.

For example, if you are not a senior citizen and deposit Rs 5 lakh in a 5-year FD in SBI, then on maturity you will get a total of Rs 6,90,209 lakh. On the other hand, if you invest the same amount in a post office TD, then you will get a total of Rs 7,24,974 on maturity. That is, you will get Rs 34,765 more in the post office compared to the State Bank of India.

A Smarter Choice for Higher Returns

Post Office Fixed Deposits (FDs) offer a more lucrative investment option compared to traditional bank FDs like SBI FDs. With a higher interest rate of 7.5%, Post Office FDs provide a higher return on investment.

Why Choose Post Office FDs?

- Higher Interest Rates: Earn more on your investments.

- Government Backed: Enjoy the highest level of security.

- Flexible Tenures: Choose a tenure that suits your financial goals.

- Easy Accessibility: Convenient deposit and withdrawal options.

Example:

| Invested Amount | Post Office FD Return | SBI FD Return |

|---|---|---|

| Rs 1,00,000 | Rs 44,995 | Rs 38,042 |

| Rs 3,00,000 | Rs 1,34,984 | Rs 1,14,126 |

| Rs 5,00,000 | Rs 2,24,974 | Rs 1,90,210 |