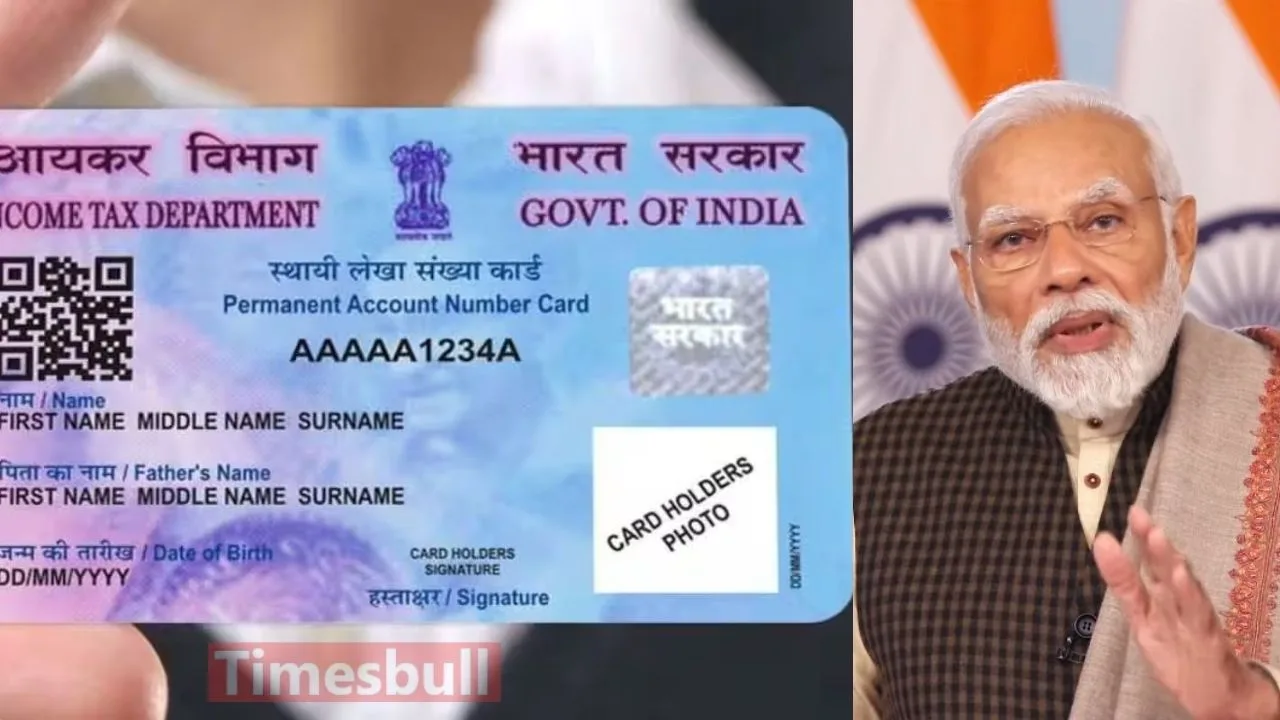

A PAN card is an essential document for various financial activities, including filing income tax returns. It plays a crucial role in significant transactions as well. There is often some confusion about the validity of a PAN card, with many believing it expires after 10 years. Let’s clarify the facts.

What is the validity of a PAN card?

The PAN card remains valid indefinitely, as its 10-digit alphanumeric number is permanent (Permanent Account Number). This means that the PAN card does not expire and cannot be canceled or surrendered. You can update other information, but the PAN card number itself remains unchanged.

What if you have multiple PAN cards?

According to section 139A of the Income Tax Act 1961, an individual is allowed to hold only one PAN card. If a PAN card has already been issued in someone’s name, they cannot apply for another. Doing so may result in a penalty of up to Rs 10,000 for breaching section 139A.

How to obtain a PAN card

You can apply for a PAN card either online or offline. To get a new or duplicate PAN card, visit the official website of the Income Tax Department. Navigate to the NSDL or UTIITSL websites and follow the provided instructions. Complete Form 49A or Form 49AA. For offline applications, print the form, gather the required documents, and visit a PAN card center or authorized service provider to complete the process. Additionally, you can opt for an e-PAN, which can be obtained from the NSDL PAN portal.