Everyone wants to earn a profit by investing their money. The government and banks run many schemes where people can invest and earn returns. However, most people prefer to invest their money in bank FDs. The main reason for this is that FDs are 100% safe. Additionally, the returns on bank FDs are fixed, providing a secure investment option.

If you also prefer bank FDs for investment, it is important to know which bank offers the highest returns. Today, we will tell you about a special FD scheme from the Bank of Baroda, where you can earn good profits in a short period. Let’s find out the details.

Bank of Baroda FD (BOB FD) Overview

Bank of Baroda offers a variety of Fixed Deposit (FD) schemes, ranging from short-term to long-term investments. The interest rates for these FDs range from 4.25% to 7.30%. If you’re looking for a short-term investment, you can opt for the 211-day FD offered by the bank. In this FD, general citizens receive an interest rate of 6.25%, while senior citizens get 6.75%.

How to Earn Up to Rs 15,000 Profit

If you invest Rs 4 lakh in Bank of Baroda’s 211-day FD, you will receive Rs 4,14,600 upon maturity. Senior citizens, on the other hand, will receive Rs 4,15,781 upon maturity.

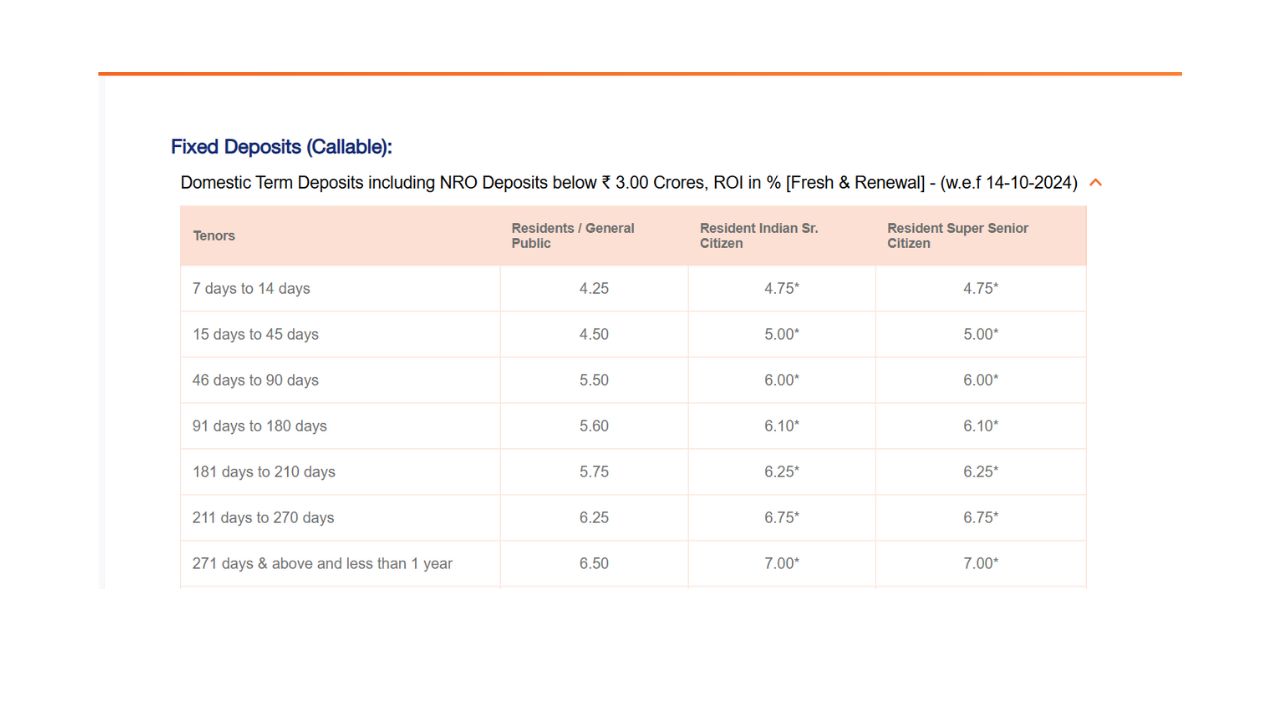

Bank of Baroda FD Interest Rates for 2025

The following interest rates are applicable for deposits below Rs. 3 crore and are effective from August 13, 2024:

| Deposit Tenure | Interest Rate for Regular Customers (% p.a.) | Interest Rate for Senior Citizens (% p.a.) |

|---|---|---|

| 7 days to 14 days | 4.25% | 4.75% |

| 15 days to 45 days | 4.50% | 5.00% |

| 46 days to 90 days | 5.50% | 6.00% |

| 91 days to 180 days | 5.60% | 6.10% |

| 181 days to 210 days | 5.75% | 6.25% |

| 211 days to 270 days | 6.15% | 6.65% |

| 271 days & above (less than 1 year) | 6.25% | 6.75% |

| 333 days (BOB Monsoon Dhamaka Deposit) | 7.15% | 7.65% |

| 360 days (BOB 360) | 7.10% | 7.60% |

| 1 year | 6.85% | 7.35% |

| 399 days (BOB Monsoon Dhamaka Deposit) | 7.25% | 7.75% |

| Above 1 year to 400 days | 6.85% | 7.35% |

| Above 400 days to 2 years | 6.85% | 7.35% |

| Above 2 years to 3 years | 7.15% | 7.65% |

| Above 3 years to 5 years | 6.50% | 7.15% |

| Above 5 years to 10 years | 6.50% | 7.50% |

| Above 10 years (MACT/ MACAD Court Order schemes only) | 6.25% | 6.75% |

Note: Interest rates are subject to change from time to time.

Basic Eligibility Criteria for Bank of Baroda FD

- Individuals (singly or jointly)

- Hindu Undivided Families (HUFs)

- Minors above 14 years (as per bank rules)

- Clubs, associations, educational institutions, partnerships, joint-stock companies, and any other institutions are eligible to open an FD account according to bank rules.