Bank FD Schemes Update: With guaranteed returns and high liquidity, Fixed Deposit (FD) is one of the most preferred investment options in our country. If you want higher interest on your FD, this news is for you. Banks are offering better interest rates on FDs to attract more deposits. Along with major banks like SBI and HDFC Bank, smaller banks have also increased FD interest rates recently.

SBI Introduces New Category for Super Senior Citizens (Above 80 Years)

SBI has recently added a new category, Super Senior Citizen (for those above 80 years), offering an additional 10 basis points in interest to depositors in this category. A similar scheme is also being run by IDBI Bank.

IDBI Bank Launches ‘Chiranjeevi-Super Senior Citizen FD’ Scheme

IDBI Bank has introduced the ‘IDBI Chiranjeevi-Super Senior Citizen FD’, a special FD scheme for people aged 80 years and above. This scheme offers 0.65% more interest than standard FD rates. Under this scheme, interest rates are:

- 8.05% for a 555-day FD

- 7.9% for a 375-day FD

- 8% for a 444-day FD

- 7.85% for a 700-day FD

Superb news for India’s super seniors! 🌟 IDBI Bank launches the ‘Chiranjeevi-Super Senior Citizen FD’ for those aged 80+! 💰 Get 65 basis points above standard rates & 15 basis points above senior rates. A step towards financial empowerment! #IDBIBank #PositiveNews pic.twitter.com/1HE2oiy1Kk

— Scoreclever News (@scoreclever_eng) January 22, 2025

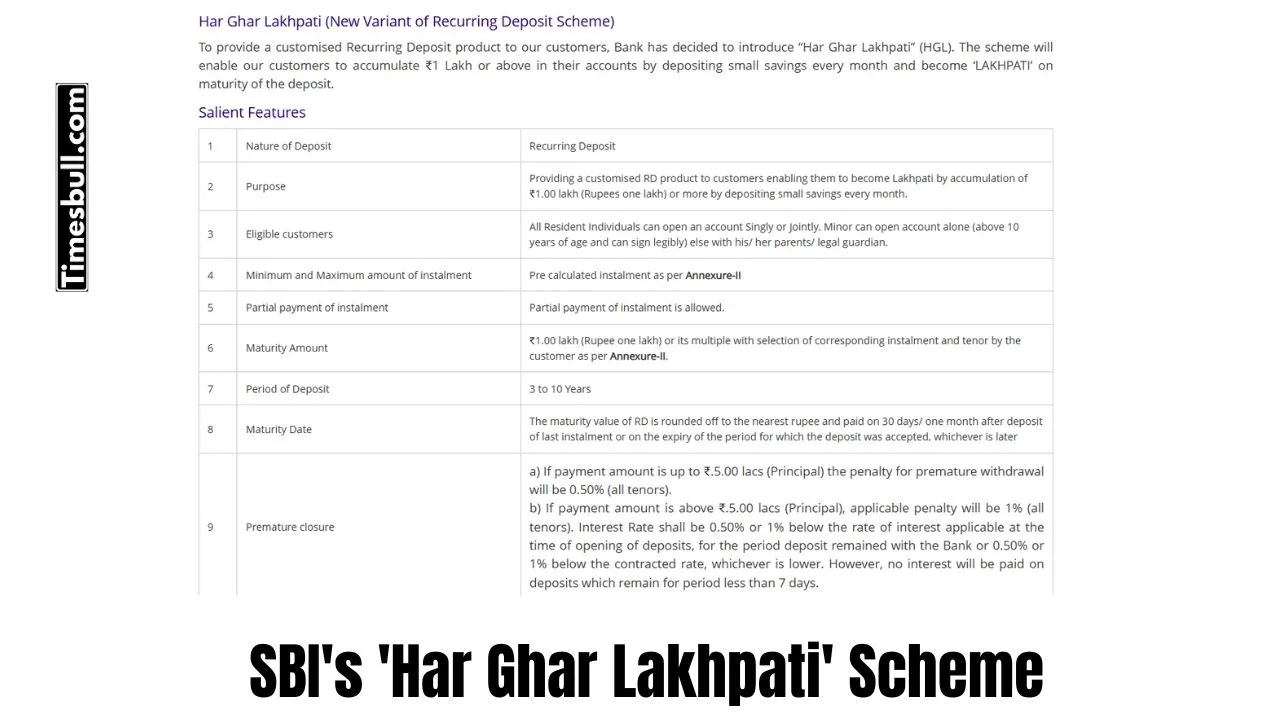

SBI’s ‘Har Ghar Lakhpati’ Scheme

SBI has launched the ‘Har Ghar Lakhpati’ RD scheme, aimed at helping individuals accumulate one lakh or more through monthly deposits over 3 to 10 years.

- For those under 60 years, the interest rate is 6.75% for 3-4 years and 6.50% for 5-10 years.

- For those above 60 years, the interest rate is 7.25% for 3-4 years and 7% for 5-10 years.

Bank of Baroda Launches Liquid Fixed Deposit

Bank of Baroda has introduced a liquid fixed deposit, allowing customers to withdraw in units of ₹1,000 after an initial deposit of ₹5,000.

Disclaimer:

The information provided in this article is for informational purposes only and is not intended as financial advice. Interest rates, schemes, and terms are subject to change by the respective banks. Please verify all details with the banks before making any investment decisions. Times Bull will not be responsible for any financial investments made, as it is entirely your responsibility. Please consult a financial advisor for better results.