Having a budget helps you see where your money is going. You can put aside money for bills and expenses and set up a plan to reach your financial goals.

Follow these steps to get started. Use how often you get paid as the timeframe for your budget. For example, if you get paid weekly, set up a weekly budget.

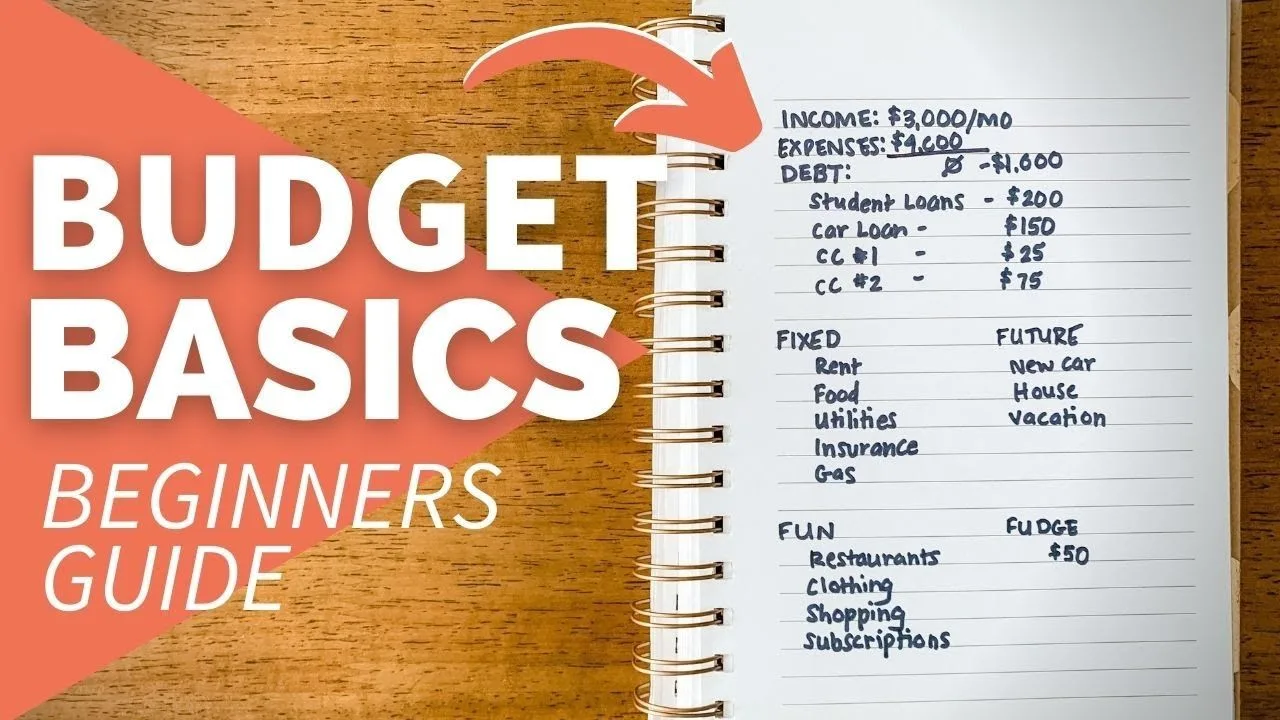

Record your income

Record how much money is coming in and when. If you don’t have a regular income, work out an average amount.

Make a list of all the money coming in, including:

- how much

- where from

- how often (weekly, fortnightly, monthly or yearly)

This money could be from your wages, pension, government benefit or payment, or income from investments.

Add up your expenses

Regular expenses are your ‘needs’ – the essential items you need to pay for to live. These include-

Fixed expenses, for example:

- rent or mortgage payments

- electricity, gas, and phone bills

- council rates

- household expenses, like food and groceries

- medical costs and insurance

- transport costs, like car registration or public transport

- family costs, like baby products, child care, school fees, and sporting activities

Debt expenses, for example-

- personal loan repayments

- credit card payments

- mortgage repayments

Unexpected expenses, for example-

- car repairs and services

- medical bills

- extra school costs

- pet costs

To make sure you’ve recorded all your expenses, look at your bills or bank statements. Include what the expense is for, how much, and when you pay it.

If you track your spending, use your list of transactions.

Set your spending limit

The money you have left after expenses is your spending and saving money. Your spending money is for ‘wants’, such as entertainment, eating out, and hobbies.

Make a plan for what you want to do with your spending money. This will help you to see where it goes and keep within your spending limit.

Set your savings goal

If you have a savings goal you can use your budget to work towards it. Once you know how much money you have for ‘wants’, you can work out how much of it you’d like to save.

Having some savings can create a safety net for unexpected expenses. Even a small amount set aside regularly will make a difference.

Adjust your budget

Your budget needs to work for you and your lifestyle so it’s important to adjust your budget as things change.

For example, if your expenses start to increase you may need to reduce your spending, or change your savings goal. Or you might be able to save more if you get a pay rise or you pay off some debt.

Make budgeting easier

To help make budgeting easier, consider having separate bank accounts. You could have-

- a transaction account for bills and expenses

- a transaction account for spending

- a higher-interest savings account

You can then automate your budget by setting up a regular transfer to your savings account on payday. You can also set up direct debits when your bills are due.