How to File Income Tax Return: An Income Tax Return (ITR) is a form that enables a taxpayer to declare his income, expenses, tax deductions, investments, taxes, etc. The Income-tax Act, 1961 makes it mandatory for a taxpayer to file an income tax return under various scenarios.

Step-by-Step on How to E-file ITR on the Income Tax Portal

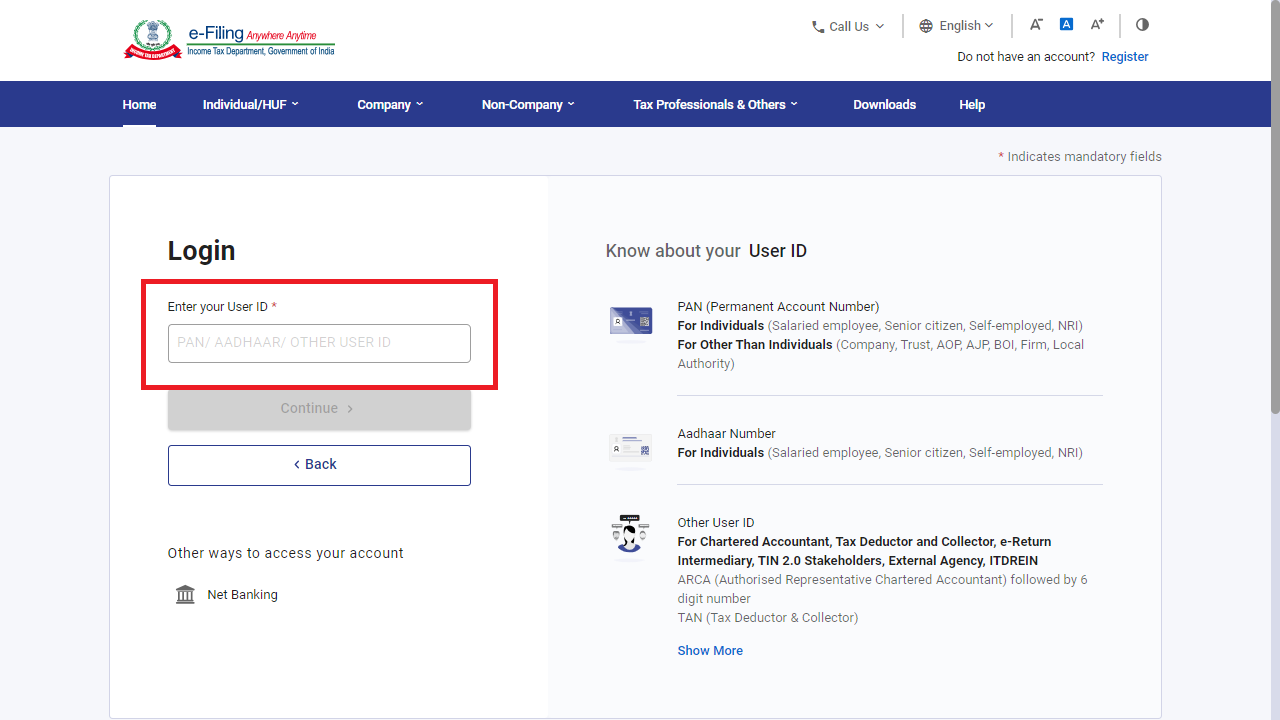

Step 1: Login

- Visit the official Income Tax e-filing website and click on ‘Login’.

- Enter your PAN in the User ID section.

- Click on ‘Continue’.

- Check the security message in the tickbox.

- Enter your password

- ‘Continue’

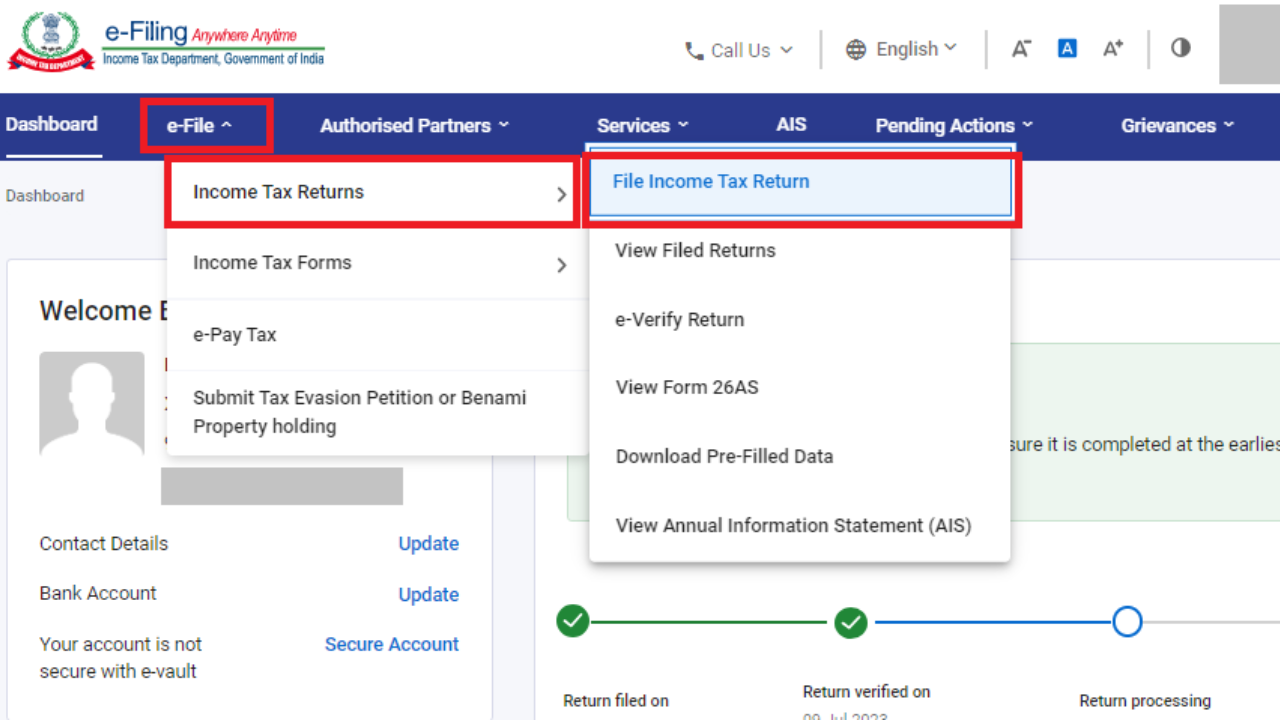

Step 2: Go To ‘File Income Tax Return’

Click on the ‘e-File’ tab > ‘Income Tax Returns’ > ‘File Income Tax Return’

Step 3: Select The Right ‘Assessment Year’

Select ‘Assessment Year’ as ‘AY 2024-25’ if you file for FY 2023-24. Similarly, select ‘AY 2023-24’ if you are filing for FY 2022-23 and use the mode of filing as ‘Online’. Select the filing type correctly as original return or revised return.

Step 4: Select The Status

- Select your applicable filing status: Individual, HUF, or Others.

- For filing of persons like you and me, select ‘Individual’ and ‘Continue’.

Step 5: Select ITR Type

Now, select ITR type. The taxpayer must first ascertain which ITR form they must fill out before filing returns. There are a total of 7 ITR forms available, of which ITR 1 to 4 is applicable for Individuals and HUFs

Step 6: Choose the Reason For Filing ITR

Select the appropriate option that is applicable to your situation:

- Taxable income is more than the basic exemption limit

- Meets specific criteria and is mandatorily required to file ITR

Step 7: Validate Pre-filled Information

Most of the details, such as your PAN, Aadhaar, Name, Date of birth, contact information, and bank details will be pre-filled.

Validate these details carefully before you proceed further. Also, provide your bank account information. If you have already provided these details, ensure they are pre-validated.

Step 8: E-verify ITR

The last and crucial step is to verify your return within the time limit (30 days). Failing to verify your return is equivalent to not filing it at all.

Documents Required for Filing ITR

The following documents/information are required for e-filing their ITR:

- PAN and Aadhaar

- Bank Statements

- Form 16

- Donation receipts

- Stock trading statements from the broker platform

- Insurance policy paid receipts related to life and health

- Bank account information linked to PAN

- Aadhaar registered mobile number for e-verifying the return

- Interest certificates from banks