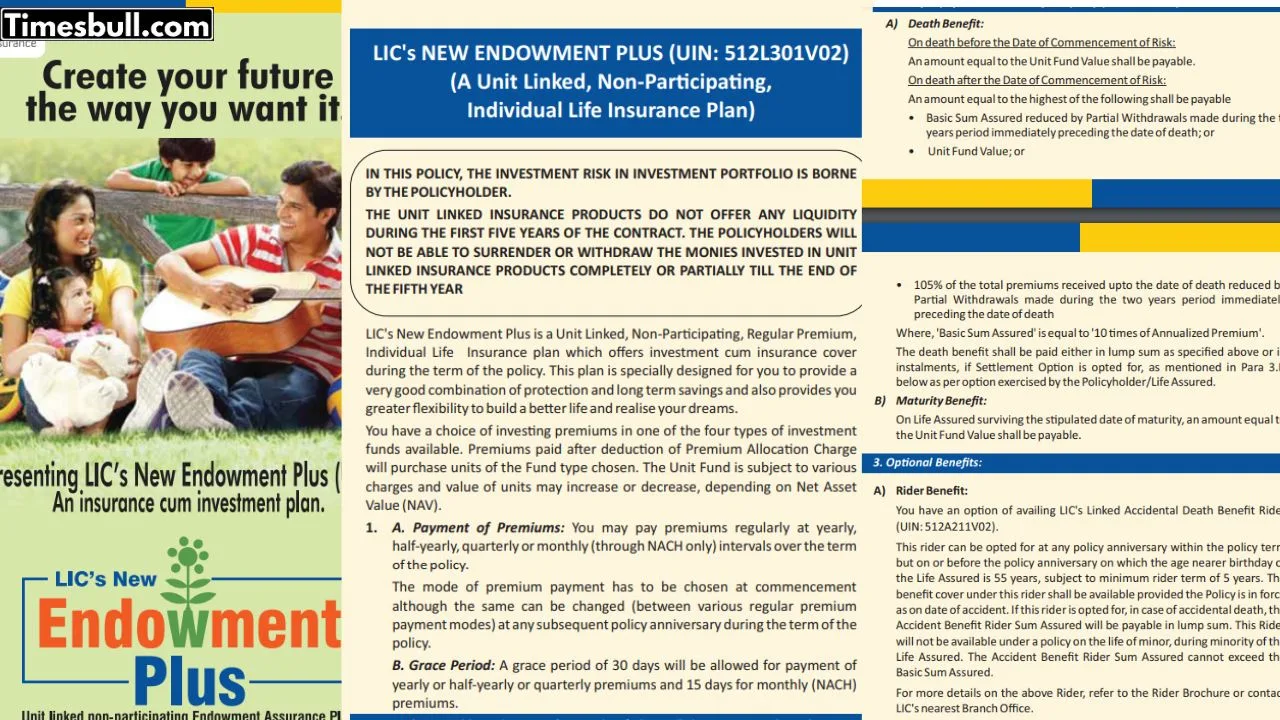

LIC New Endowment Plus Plan Update: If you want to invest in a scheme that offers higher profits with a smaller investment, this news is very useful for you. Here, we are telling you about LIC New Endowment Plus. LIC New Endowment Plus is a unit-linked, regular premium, non-participating insurance plan that offers the dual benefits of savings and insurance. This scheme was launched to provide a good combination of security and long-term savings for the policyholder.

Old Plan Discontinued

Under this scheme, the policyholder can choose from four investment funds: Bond, Security, Balanced, and Growth Fund. The old Endowment Plus Plan (Table No. 835), launched in 2015, was discontinued on 1st February 2020. It was replaced with the new Endowment Plus Plan (Table No. 935).

LIC New Endowment Plus Plan: Premium Payment Duration

The policyholder can pay premiums regularly at annual, half-yearly, quarterly, or monthly intervals using online payment methods until the policy matures. A grace period of 30 days is allowed for annual, half-yearly, or quarterly premiums, while a grace period of 15 days is provided for monthly premiums if the due date is missed.

Eligibility and Age Limit for This Scheme

The minimum age to purchase LIC’s New Endowment Plus plan is 90 days, and the maximum age is 50 years. The policy’s maturity age range is between 18 and 60 years.

अपने रिटायरमेंट की योजना बनाएं एलआयसी के जीवन अक्षय VII के साथ, जिसमें चुनने के लिए 10 विकल्प हैं। अधिक जानकारी के लिए, अपने LIC एजेंट/शाखा से संपर्क करें या https://t.co/3kwFCrnDSw पर जाएं।#LIC #JeevanAkshayVII #Retirement #Pension #PensionPlan pic.twitter.com/yO2SRtwdTi

— LIC India Forever (@LICIndiaForever) January 30, 2025

Death Benefit

If the policyholder dies before the risk commencement date, the total fund value will be paid to the nominee. If the policyholder dies after the risk commencement date, the nominee will receive the higher of the following amounts:

- 105% of the total premiums paid

- 10 times the annual premium

- Total fund value