Life Insurance Corporation (LIC) offers a range of investment options that ensure impressive returns and the safety of your investment. Among these is the LIC Saral Pension Scheme, a Standard Immediate Annuity plan that allows you to secure your financial future. Designed by the guidelines of the Insurance Regulatory and Development Authority of India (IRDAI), this scheme stands out as a reliable choice for investors. This article will provide comprehensive details about this special scheme from LIC.

Benefits of LIC Saral Pension Yojana

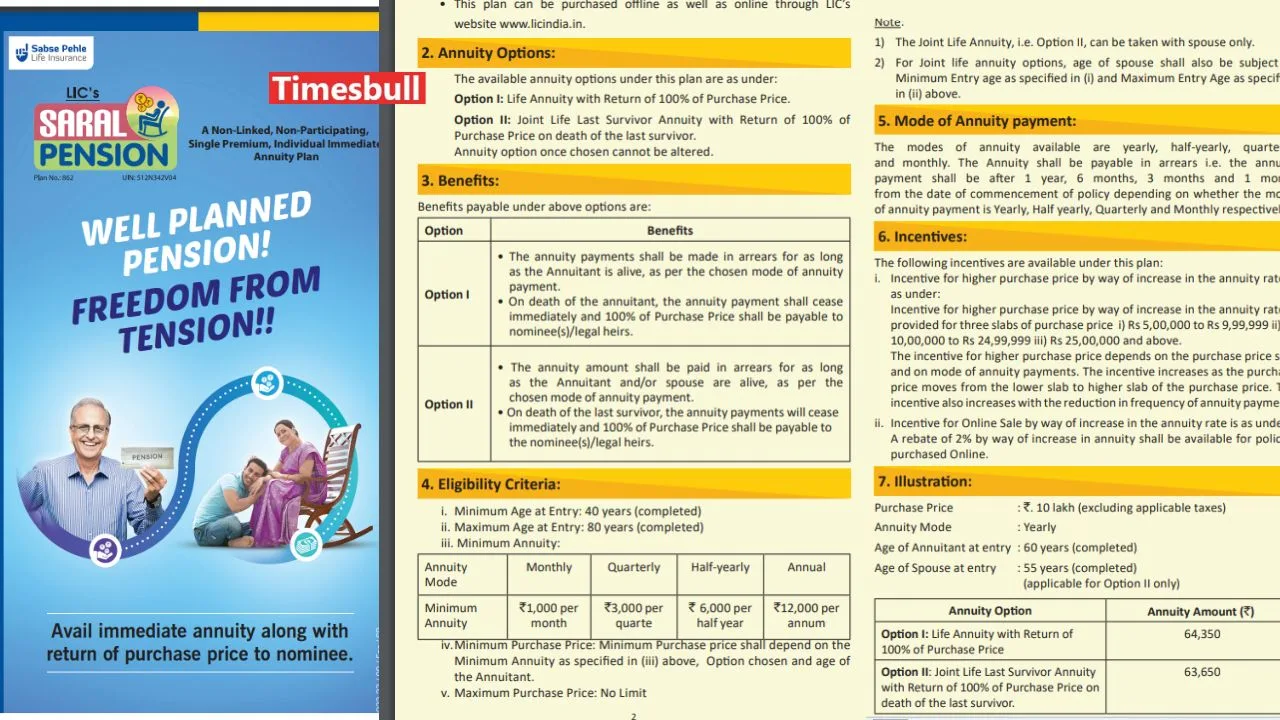

1. Option I:

- Annuity payments will be made in arrears for as long as the annuitant is alive, based on the chosen mode of annuity payment.

- Upon the annuitant’s death, annuity payments will cease, and 100% of the purchase price will be paid to the nominee(s) or legal heirs.

2. Option II:

- Based on the chosen mode of annuity payment, annuity payments will be made in arrears for as long as either the annuitant or their spouse is alive.

- Upon the death of the last survivor, the annuity payments will cease, and 100% of the purchase price will be paid to the nominee(s) or legal heirs.

Eligibility Criteria for LIC Saral Pension Yojana

- Minimum Age at Entry: 40 years (completed)

- Maximum Age at Entry: 80 years (completed)

- Minimum Annuity Amount:

- Monthly: ₹1,000

- Quarterly: ₹3,000

- Half-yearly: ₹6,000

- Annually: ₹12,000

- Minimum Purchase Price: Depends on the minimum annuity, option chosen, and the age of the annuitant.

- Maximum Purchase Price: No limit.

Note:

- Option II (Joint Life Annuity) can only be taken with the spouse.

- The spouse must meet the same minimum and maximum age requirements.

Age Limit for Investing in LIC Saral Pension Yojana

- Minimum Age: 40 years

- Maximum Age: 80 years

Annuity Options in LIC Saral Pension Plan

LIC Saral Pension Plan provides two annuity options for investors to choose from:

- Option 1: The annuity is provided with a 100% return on the purchase price.

- Option 2: A joint-life last-survivor option, where the annuity continues for the surviving partner with a 100% return on the purchase price.

How to Invest in the LIC Saral Pension Plan?

To invest in the LIC Saral Pension Plan:

- Visit a LIC agent or the nearest LIC office.

- You can also invest online through www.licindia.in.

Mode of Annuity Payment

The available modes of annuity payment are:

- Yearly

- Half-yearly

- Quarterly

- Monthly

Payments are made in arrears, meaning the annuity payment will be made after 1 year, 6 months, 3 months, or 1 month depending on the chosen payment frequency.

Disclaimer: Times Bull will not be responsible for any financial investments made, as it is entirely your responsibility. Please consult a financial advisor for better results.