To secure both our present and future, we all want to invest in a scheme that will provide strong returns later. If you also wish to receive a strong return or a monthly pension like a salary and want to spend your old age peacefully, then you can consider the special plan offered by the Life Insurance Corporation of India (LIC).

Yes, LIC is offering a special scheme that will allow you to receive a pension of up to Rs 12,000 every month in your old age. Let us tell you more about LIC’s special pension scheme. Throughout this article, we will share all the details regarding this scheme.

LIC Pension Scheme: Secure Your Future with Regular Pension

Today’s savings can benefit you tomorrow, allowing you to enjoy a peaceful life in your old age. LIC (Life Insurance Corporation of India) offers a special pension scheme that provides a pension of up to Rs 12,000 every month in your retirement years.

LIC Saral Pension Plan: High Returns with One-Time Investment

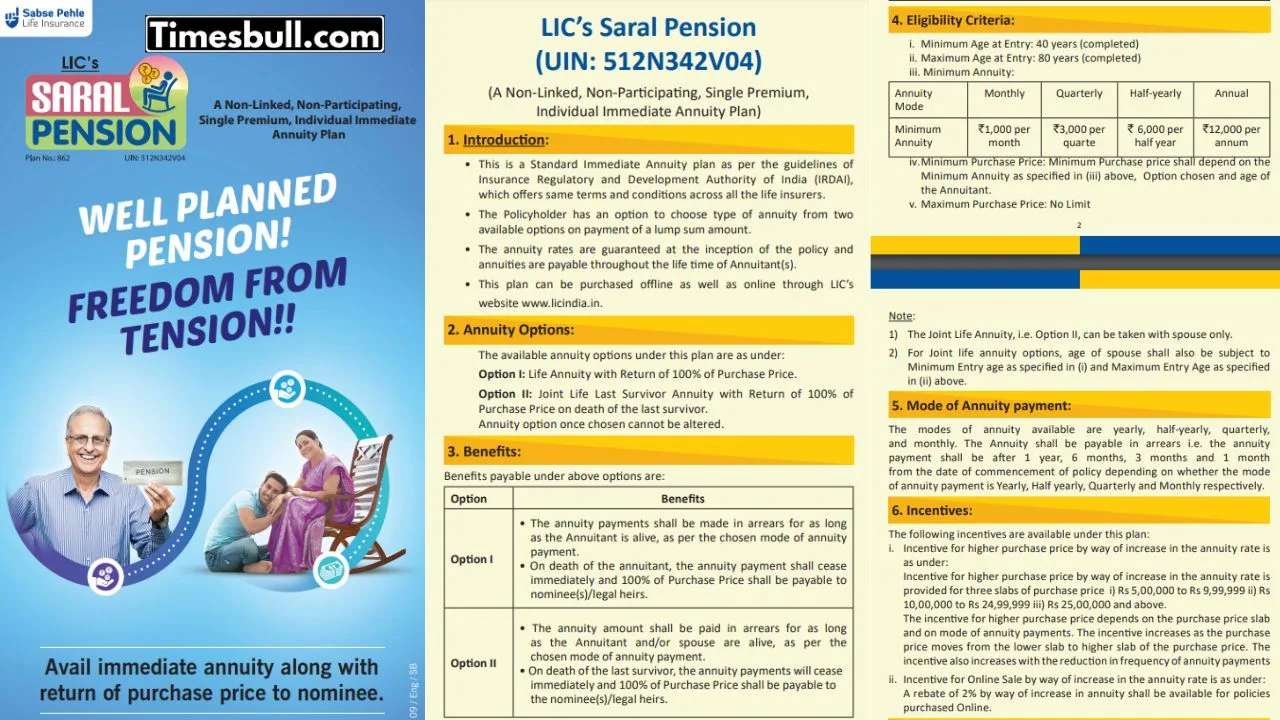

The LIC Saral Pension Plan is a high-return scheme, and it doesn’t require monthly investments. By making a one-time investment, you can receive a pension of up to Rs 12,000 every month during your old age.

Eligibility for LIC Saral Pension Plan

- Minimum entry age: 40 years

- Maximum entry age: 80 years

- Single individuals or couples can invest together

LIC Saral Pension Scheme Benefits

- Surrender option available 6 months after policy commencement

- In case of the policyholder’s death, the investment amount is returned to the nominee

- Loan facility available 6 months after policy commencement

LIC Saral Pension Plan Calculator

In this scheme, the minimum pension is Rs 1,000, with no limit on the maximum pension. The pension amount depends on your investment and can be received monthly, quarterly, half-yearly, or annually. By making a lump sum investment, you can purchase an annuity. For example, if you are 42 years old and invest Rs 30 lakh, you will receive a monthly pension of Rs 12,388.

How to Get the Benefits of the LIC Saral Pension Plan

You can invest in the LIC Saral Pension Scheme either online or offline. To invest online, simply visit the official LIC website.