LIC Aadhaar Shila Policy Update: LIC runs several schemes that provide good returns and future security. If you are looking for an LIC policy for investment, we have details about a plan that offers a total benefit of ₹11 lakh. This scheme is known as the LIC Aadhaar Shila Plan. This article will share all the details regarding the LIC Aadhaar Shila Plan, including its eligibility, benefits, and other important information. If you wish to apply for this plan, read this article carefully.

Deposit Just ₹87 Every Day

This LIC policy offers great returns, specifically designed for women. By investing just ₹87 daily, you can accumulate a significant amount by the time of maturity. Here’s what makes this scheme special:

Key Features of LIC Aadhaar Shila Plan:

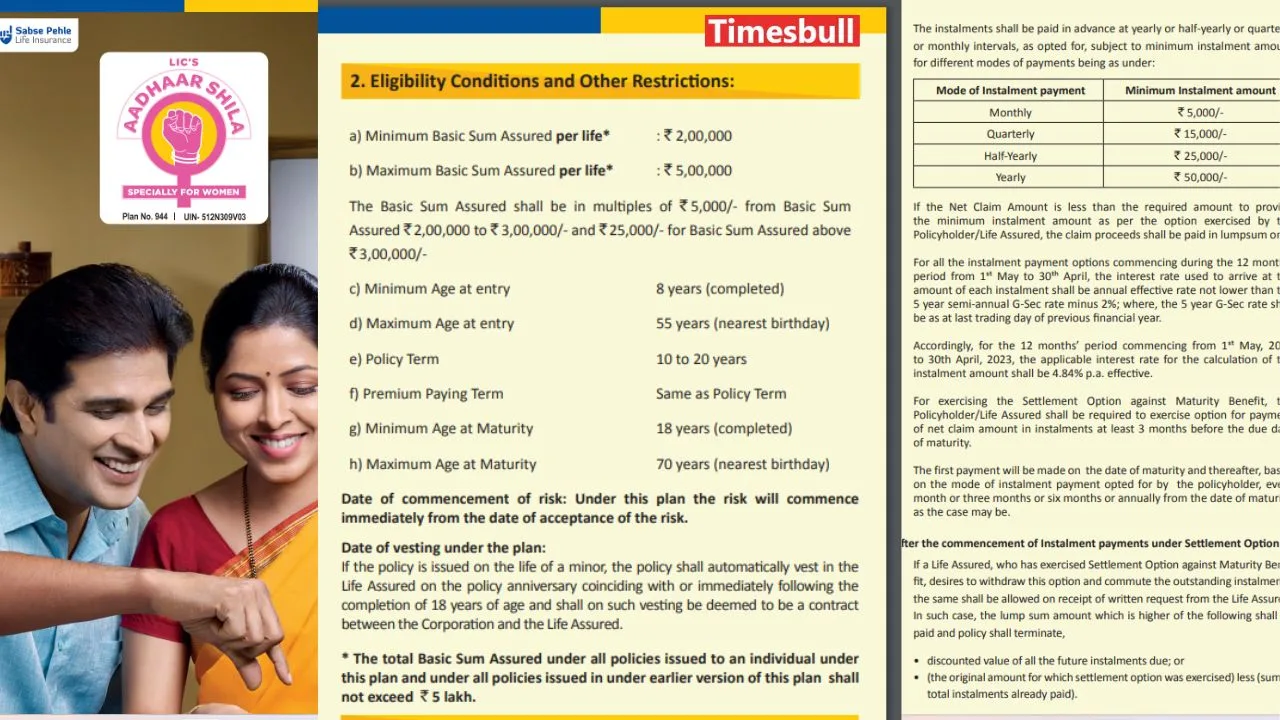

Eligibility: Women between the ages of 8 and 55 can invest in the LIC Aadhaar Shila scheme.

Type of Policy: This is a non-linked, individual life insurance plan designed for women.

Financial Security: In case of the policyholder’s death, the family receives financial support.

Maturity Period: The LIC Aadhaar Shila policy matures between 10 to 20 years.

Investment Options: Up to ₹3 Lakh

Women can invest up to ₹3 lakh in the LIC Aadhaar Shila plan. The scheme offers flexible payment options—monthly, quarterly, half-yearly, or yearly instalments.

Death Benefit

In the unfortunate event of the life assured’s demise, the nominee is entitled to receive a death benefit:

- Within the first five policy years: The nominee receives the sum assured amount on death.

- After the first five years but before the maturity date: The nominee receives the sum assured amount along with any loyalty additions.

The death benefit payable is determined as the higher of:

- 7 times the annualized premium

- 110% of the basic sum assured amount

How Long Will You Have to Deposit?

Let’s break down how the LIC Aadhaar Shila policy works. For example, if a female investor starts at age 15 and deposits ₹87 daily, she will contribute ₹31,755 annually. After 10 years, the total investment would amount to ₹3,17,550.

Maturity Benefits: Get ₹11 Lakh on Maturity

This policy’s maturity period can extend to 70 years. By the time of maturity, you could receive a lump sum of approximately ₹11 lakh, offering strong financial returns for your future.

Investing in this scheme now can help you plan your finances for old age and ensure financial security.

Disclaimer: Times Bull will not be responsible for any financial investments made, as it is entirely your responsibility. Please consult a financial advisor for better results.