There is good news for farmers. The state government has launched a plan to waive the interest on old loans taken by farmers. A total of 36,351 farmers will benefit from this government scheme. The government is waiving the interest on their old loans so that these farmers can qualify for a new loan from the bank. When farmers fail to repay their loans, banks declare them defaulters, making it impossible for them to get loans again. To solve this problem, the state government has introduced the “Ek Musht Samjhauta Yojana,” allowing defaulter farmers to clear their old loans and become eligible for new loans to support their farming.

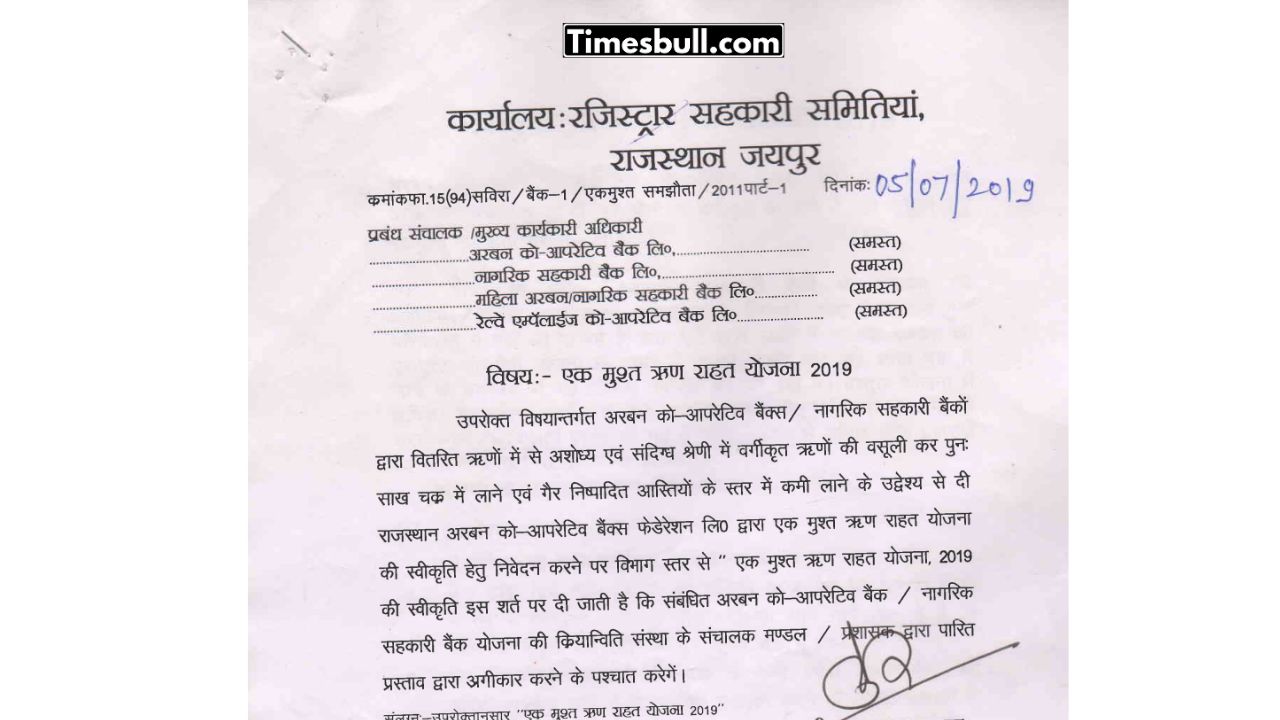

What is the One-Time Settlement Scheme?

The state government has introduced a One-Time Settlement Scheme (OTS) (Ek Musht Samjhauta Yojana) for farmers. Under this scheme, farmers who repay 100% of the principal amount of their medium-term and long-term loans from Land Development Banks (LDBs) will receive a 100% waiver on interest. This means no interest will be charged on their overdue loans.

The overdue loan amount in Land Development Banks has reached approximately ₹760 crore. To compensate for this, the Chief Minister has allocated ₹200 crore, which will be used to waive the interest for farmers.

Who Can Benefit from This Scheme?

According to the Cooperative Minister, many farmers could not repay their loans in recent years due to natural disasters. As a result, their loans became overdue, totalling ₹760 crores. The OTS scheme aims to help these farmers by waiving interest, making it easier for banks to recover their loans and improve their financial condition.

100% Interest Waiver for Farmers

The state government’s “Suraj Sankalp” plan ensures that farmers’ lands will not be auctioned for loan recovery. Under this scheme, all auction proceedings by Land Development Banks have been put on hold. Farmers who repay their principal loan amount by July 1, 2024, will receive a 100% interest waiver, providing major financial relief.

Farmers Can Get New Loans at 5% Interest

With the implementation of the OTS scheme, 36,351 farmers with overdue loans in Land Development Banks will become eligible for new loans. These loans will be available under the state government’s 5% interest subsidy scheme for both agricultural and non-agricultural activities. This will allow defaulter farmers to access fresh credit for farming and other needs.

How to Apply for the One-Time Settlement Scheme?

If you are a farmer from Rajasthan, you can benefit from this scheme, as the Rajasthan government is offering relief on overdue medium-term and long-term loans.

Steps to Apply:

- Visit Your Bank – Contact the Land Development Bank or the financial institution from which you took the loan.

- Check Eligibility – Get details about the scheme’s terms and conditions from your bank.

- Submit an Application – Apply according to the bank’s procedure.

- Deadline – Farmers can avail of this scheme until March 31, 2025.

For more details, visit the nearest branch of your Land Development Bank.

Banks Covered Under the Scheme

This scheme is applicable for loans from:

- Land Development Bank (LDB)

- State Cooperative Agriculture and Rural Development Bank

- Regional Rural Banks

- State Cooperative Banks

- District Central Cooperative Banks

- Commercial Banks

- State Agricultural Development Finance Companies

- Scheduled Primary Urban Cooperative Banks

- North-East Development Finance Corporation

- Non-Banking Finance Companies (NBFCs)

- Micro Finance Institutions & Small Finance Banks

This scheme provides financial relief to farmers, allowing them to clear their debts and get new loans at lower interest rates to support their livelihoods.