National Savings Certificate: Want to give a haven to your hard-earned money and also get a good return on it If yes, then National Savings Certificate (NSC) can be a great option for you.

It is a reliable savings scheme of the government, in which your money is safe and you get attractive interest. Let us know about NSC in detail.

What is the National Savings Certificate (NSC) Scheme

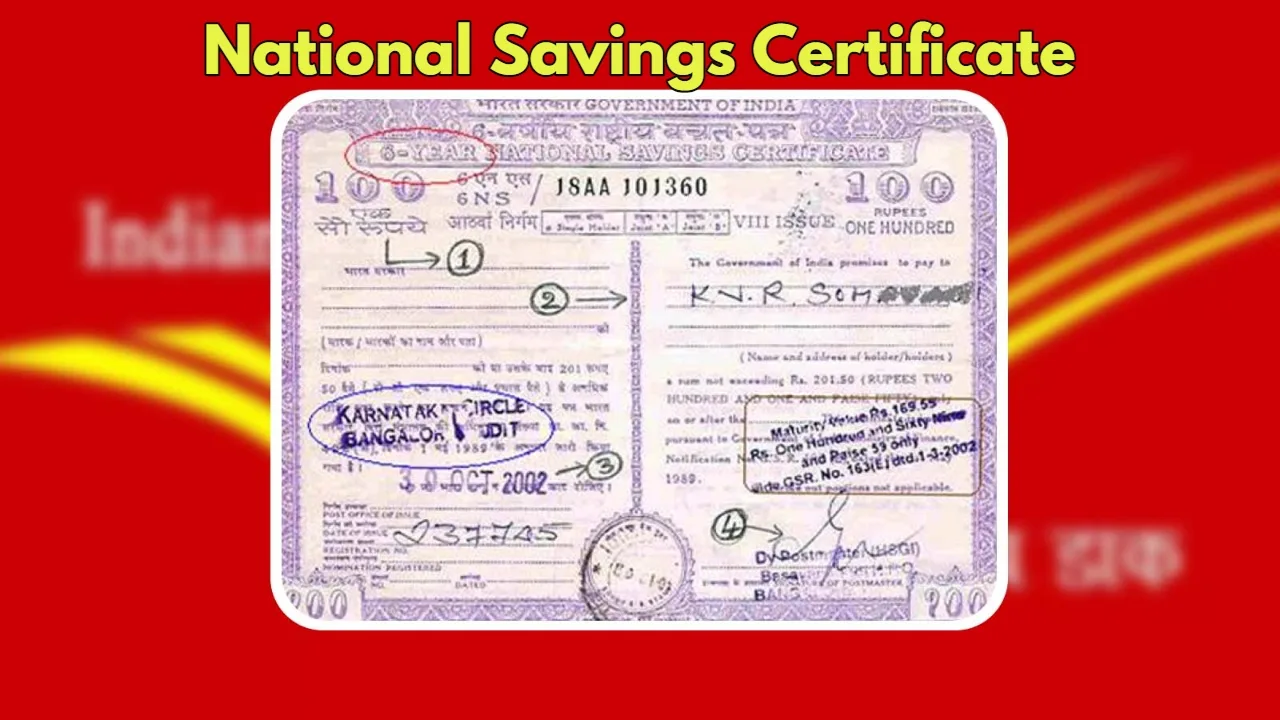

NSC is a government savings scheme in which you deposit money for a fixed period and get the principal and interest on maturity.

This scheme is ideal for those who want to invest for a long period and give priority to security.

Features of the NSC Scheme

Safe investment: Being backed by the government, it is completely safe.

Attractive interest rate: The interest rate on NSC is attractive compared to other savings schemes.

Tax benefits: Investment have been made in this scheme is eligible for tax free exemption under section 80C of the Income Tax Act.

Flexibility: You can start investing with a minimum of Rs 1000 and there is not any guidance for maximum investment limit.

How much money can you deposit in the NSC scheme

You can start investing in NSC with a minimum of Rs 1000 and thereafter deposit in multiples of Rs 100. There is not any guidance for maximum investment limit in this scheme.

How to invest in NSC

To buy NSC, you need to visit your nearest post office or authorized bank branch. You need to fill out an application form and deposit the investment amount. In return, you will get an NSC certificate.

NSC Maturity Period and Interest Rate

Maturity Period: The maturity period of NSC is 5 years.

Interest Rate: The interest rate is decided by the government every quarter. Currently, the interest rate on NSC is 7.1%. The interest is calculated on a compounded basis.

Advantages of NSC

Safe Investment: Your money is safe with the government guarantee.

Attractive returns: Your money grows over time due to compound interest.

Tax savings: There is an opportunity to save on income tax.

Loan facility: You can take a loan by pledging NSC.

NSC can be a great savings option for you, especially if you want to invest for the long term and give priority to safety.