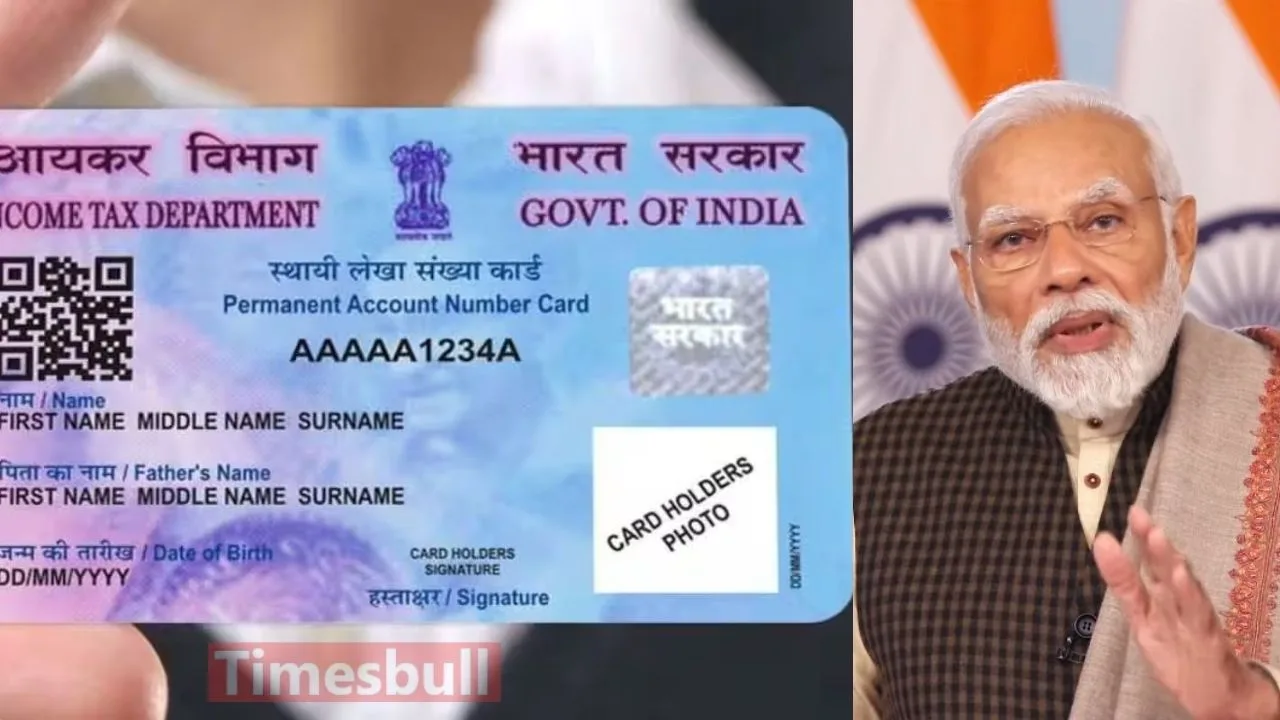

There is no end to the curiosity of the common people about the new PAN card. Taxpayers will be issued a PAN card with a QR code in the coming days. The PAN 2.0 project has been approved in the cabinet meeting chaired by Prime Minister Narendra Modi on Monday, 25 November 2024. But many questions are arising in the minds of taxpayers about PAN. Do those who already have a PAN card have to get a new PAN card? Will any change in the new PAN be possible or not? The Finance Ministry has answered 11 Frequently Asked Questions (FAQs) arising in the minds of taxpayers regarding the PAN 2.0 project.

Question 1: What is the PAN 2.0 project?

Ans: The PAN 2.0 project is an e-governance project of the Income Tax Department to bring about a paradigm shift in the business process of taxpayer registration services. Its purpose is to improve the quality of PAN services through the latest technology. Through this project, the Income Tax Department will consolidate the process of PAN allotment, update, and correction. TAN Services has also been merged with this project. Through the online PAN validation services, PAN authentication facilities will be provided to financial institutions, banks, government agencies, and central and state government departments.

Question 2: Is PAN 2.0 different from the current setup?

Ans: At present, the PAN-linked services are hosted on three different portals (e-filing portal, UTITSL portal, and Protein e-Gov portal), and the PAN/TAN services will now be hosted on a unified portal of the Income Tax Department. Services such as PAN and TAN allotment, updation, correction, online PAN validation, Know Your Assessment Officer, Aadhaar-PAN linking, PAN verification, request for e-PAN, and reprint of PAN card will be available on the new portal. And this entire process will be paperless through technology.

Question 3: Do the existing PAN cardholders have to apply for a new PAN under the upgraded system? And do I need to change my PAN number?

Ans: Existing PAN card holders are not required to apply for a new PAN under the PAN 2.0 project.

Question 4: Will it be possible to make corrections like changes in name, spelling, or address in PAN?

Ans: If PAN holders want to make changes in email, mobile number, address, or name and date of birth in their existing PAN, then they can make corrections or updates. And there will be no charge for this. Until the PAN 2.0 project rolls out, PAN holders can change their email, mobile, and address through Aadhaar-based online services. These services are available for free at these URLs.

https://www.onlineservices.nsdl.com/paam/endUserAddressUpdate.html

https://www.pan.utiitsl.com/PAN_ONLINE/homeaddresschange

In case of any other case of updation or correction in PAN details, PAN holders can do so using the existing process either by visiting physical centers or by applying online on a payment basis.

Question 5: Do I need to change my PAN card under PAN 2.0?

Ans: No, the PAN card will not be changed unless the PAN holder wants any update or correction. The existing valid PAN cards will continue to be valid under PAN 2.0.

Question 6: Many people have not changed their address, and their old address is still intact. How will the new PAN card be delivered? And when will the new PAN card be delivered?

Ans: No new PAN card will be delivered unless the PAN holders request for any update or correction in their existing PAN. PAN holders who wish to update their old address can do so for free using the Aadhaar-based online facility by visiting the URL given below. The new address will be updated in the PAN database.

https://www.pan.utiitsl.com/PAN_ONLINE/homeaddresschange

https://www.onlineservices.nsdl.com/paam/endUserAddressUpdate.html

Question – 7 – If the new PAN card QR codes are enabled, will the old ones continue to work the same? How will QR codes help us?

Ans: QR code is not a new feature, and has been included in PAN cards since 2017-18. PAN holders with old PAN cards without QR code have the option to apply for a new card with QR code in PAN 2.0 along with the existing PAN 1.0 eco-system. QR code helps in PAN and PAN details. Currently, a unique QR reader application is available for verification of QR code details. Upon reading the Reader app, complete details, i.e. Photo, Signature, Name, Father’s Name/Password will be available. Mother’s name and date of birth are displayed.

Question – 8 – What is the Common Business Identifier in Business Related Activity?

Ans: In the Union Budget 2023, it was announced that for business establishments that require PAN to be a PAN, PAN will be used as an identifier for all digital systems of directed government agencies.

Q-9 – Will the Common Business Identifier replace the existing Unique Taxpayer Identification Number (UID) such as PAN?

Ans: No. PAN will be used as a common business identifier.

Question – 10 – What is the meaning of Unified Portal?

Ans: At present, the services linked to PAN are hosted on three different portals. In the PAN 2.0 project, all PAN/TAN-linked services will be hosted on a single unified portal of the Income Tax Department. All end-to-end services related to PAN and TAN will be available on this portal, such as allotment, updation, correction, online PAN verification (OPV), Know Your AO, Aadhaar-PAN linking, verifying your PAN, request for e-PAN, request for reprint of PAN card which will further simplify the processes. And due to different modes of receiving applications (online eKYC/online paper mode/offline), delays in delivery of PAN services, delay in redressal of grievances will be avoided.

Question-11 If a person has more than one PAN, how will they be identified and how will the extra PAN be removed?

Ans: According to the provisions of the Income Tax Act, 1961, no person can hold more than one PAN. If a person holds more than one PAN, he/she will have to bring it to the notice of the assessing officer of his/her area and get the excess PAN removed or deactivated. In PAN 2.0, the possibility of a person holding more than one PAN will be reduced due to better system for identification of potential duplicate requests and centralized mechanism for resolving duplicates and improving the mechanism.