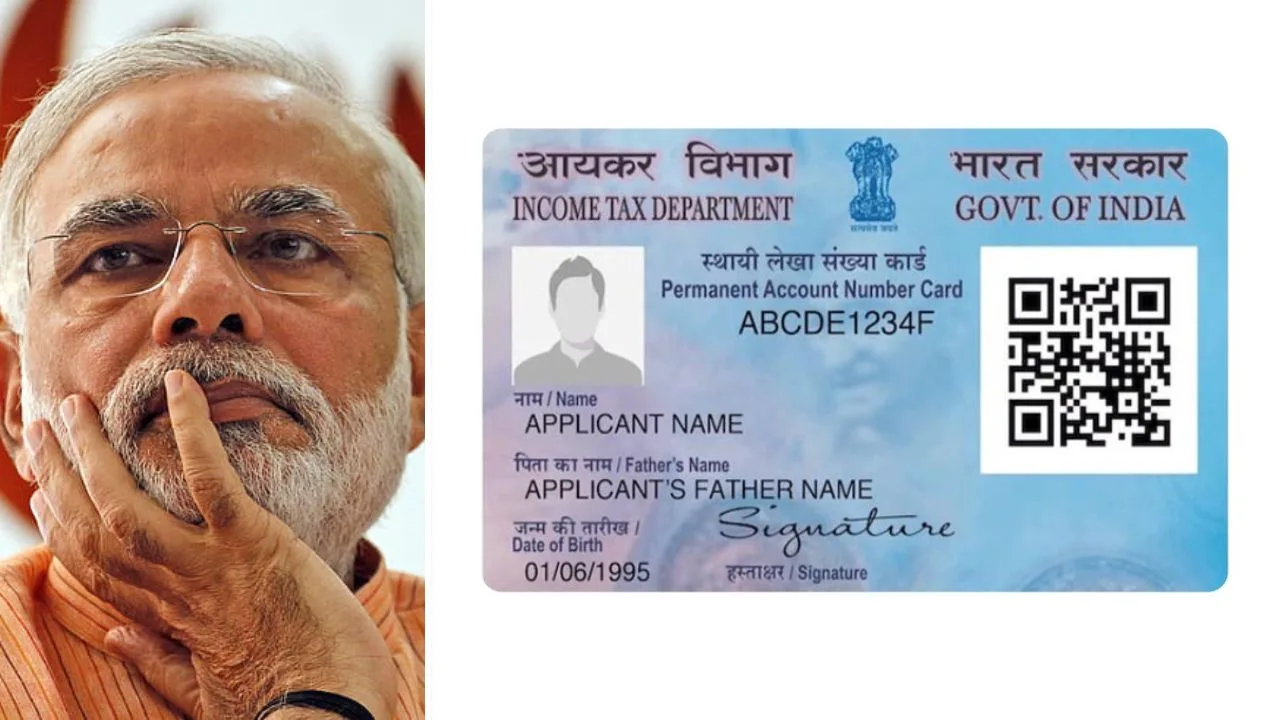

Have you ever wondered why you suddenly receive SMS alerts about your credit score or loan eligibility, even without applying for them? It turns out many fintech companies were accessing your PAN details and other personal information without consent. However, the government has stepped in to end this unauthorized access. This move aims to increase financial transparency and crack down on potential fraudulent activities across the country.

Ministry of Home Affairs Orders Access Restrictions

Following reports of unauthorized access to PAN data, the Ministry of Home Affairs has instructed the Income Tax Department to prevent fintech and loan companies from accessing PAN details without consent. Previously, several fintech firms had been using PAN information to create customer profiles without user authorization, raising privacy concerns.

PAN-Aadhaar Linkage: New Mandate for Transparency

The government has also introduced a new regulation affecting all PAN cardholders. As of November 6, it is mandatory to link PAN cards with Aadhaar for increased financial transparency and to prevent fraud. Those who haven’t yet linked the two have until December 31, 2024, to do so, or their PAN will be deactivated, leading to potential complications in financial dealings.

How This Move Benefits Financial Security

This linkage requirement aims to streamline financial records, ensure compliance with tax obligations, and reduce cases of identity theft and tax evasion. By implementing stricter rules, the government is fostering a safer financial system for all.

Consequences of Failing to Link PAN and Aadhaar

Failing to link your PAN with Aadhaar by the deadline could result in the deactivation of your PAN. This would lead to significant challenges in reactivating it and could disrupt financial transactions. The new rules intend to increase transparency and ensure that financial data is handled responsibly, reducing the risk of financial fraud and cybercrime.

New Compliance Requirements for Fintech Firms

While these regulations may impact the business practices of some fintech companies, they will encourage ethical data practices. Fintech firms will now need to adopt more transparent and compliant methods for gathering and processing customer data, which should enhance consumer trust and data security in the industry.

Protecting Your Digital Privacy: Key Takeaways for Consumers

As a consumer, it’s crucial to stay informed about data privacy regulations and exercise caution when sharing personal information online. Be mindful of permissions granted to apps and websites, and review your privacy settings regularly. This action by the government is an important step toward creating a safer digital environment, ensuring citizens’ privacy and security are protected in the digital age.

By enforcing these new rules, India is setting the stage for a more secure financial and digital landscape for everyone.