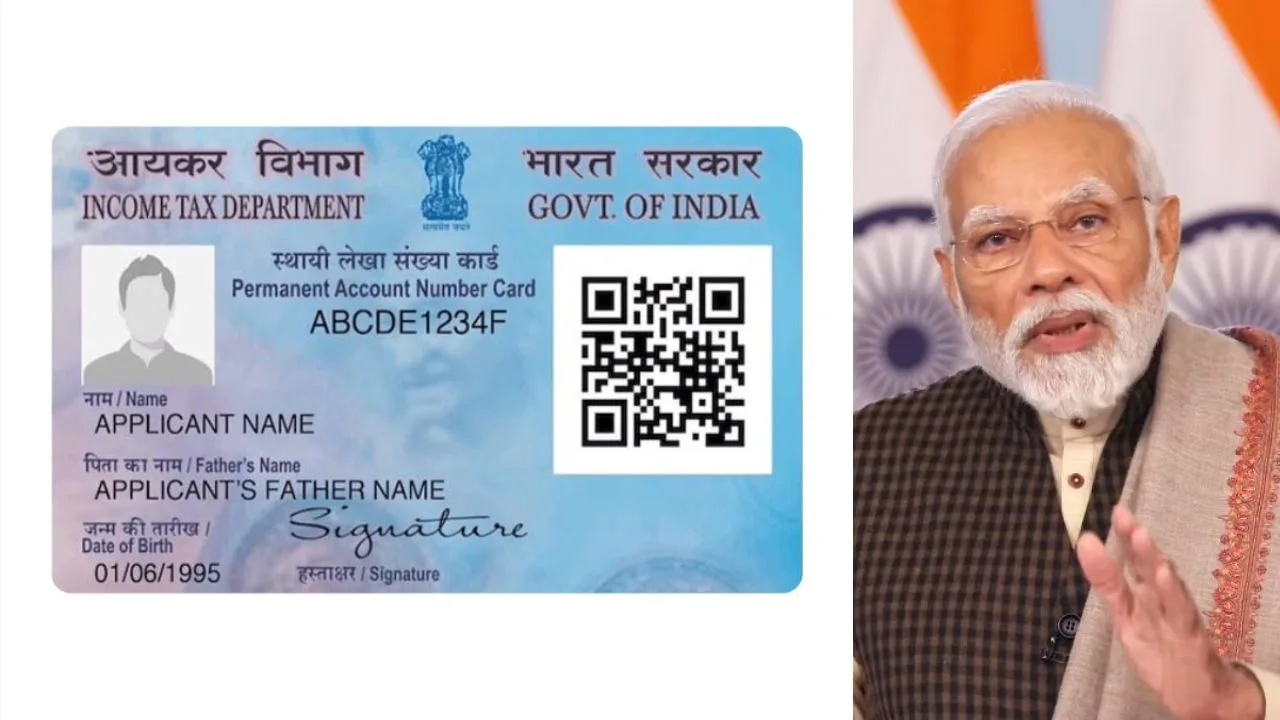

The PAN card has become an extremely important identity document for Indian citizens. It is used not only for filing income tax returns but also for various financial transactions and to avail benefits of government schemes. The importance of the PAN card has increased even further, as the government has implemented several key changes aimed at enhancing transparency and promoting security within the financial system.

New rules of PAN card and their importance

The new rules of PAN cards implemented by the government have been made keeping in mind the financial security and convenience of PAN card holders. In this news, we will know in detail what these new rules are and what effect they will have on PAN card holders.

Aadhaar-PAN linking mandatory

The government has made it mandatory to link a PAN card with Aadhaar. This step has been taken to prevent financial fraud and strengthen security. Not linking Aadhaar-PAN can cause problems in filing income tax returns and large banking transactions. Aadhaar linking will help prevent the misuse of PAN cards and ensure their authenticity.

Results of not linking Aadhaar

If PAN card holders do not link their PAN with Aadhaar, people are going to face many problems. There may be problems in banking transactions, income tax return filing may become difficult, and benefits of government schemes may be hampered. Also, the possibility of financial fraud increases.

New ten-digit PAN number

The old nine-digit number of the PAN card has now been made ten digits. This change has been made for digital security and better data management. This change will bring transparency in transactions and other financial operations related to PAN cards, which will help in controlling black money.

PAN is mandatory for transactions above Rs 50,000

Now a copy of the PAN card has been made mandatory for all transactions above Rs 50,000. This rule has been implemented to make monitoring of large financial transactions easier and to prevent illegal transactions.

Compulsory reporting of wrong transactions

If any suspicious or wrong transaction related to a PAN card is detected, it is necessary to immediately inform the bank about it. Banks will be able to take necessary action based on this information, which will protect the interests of consumers and prevent fraud.

Plans to enhance digital security

The government aims to make the PAN card system more digital and secure. There are plans to develop an integrated digital platform to strengthen the verification process of PAN cards and the security of transactions. This will also bring more transparency to financial transactions.

Here’s a quick guide to link your Aadhaar card with your PAN card:

Step 1: Visit the Income Tax Portal

Go to the Income Tax e-Filing Portal.

Step 2: Login

Log in with your PAN, Password, and Captcha Code.

Step 3: Link Aadhaar

In the dashboard, click on Profile Settings and then Link Aadhaar.

Step 4: Enter Details

Fill in your Aadhaar number, PAN, name as per Aadhaar, and the Captcha code.

Step 5: Submit

Click the Link Aadhaar to confirm. You’ll see a success message.

Step 6: Confirmation

Once linked, you’ll receive a confirmation via SMS and email.

Alternative Method:

By SMS: Send an SMS in the format: UIDPAN <Aadhaar Number> <PAN Number> to 567678 or 56161.