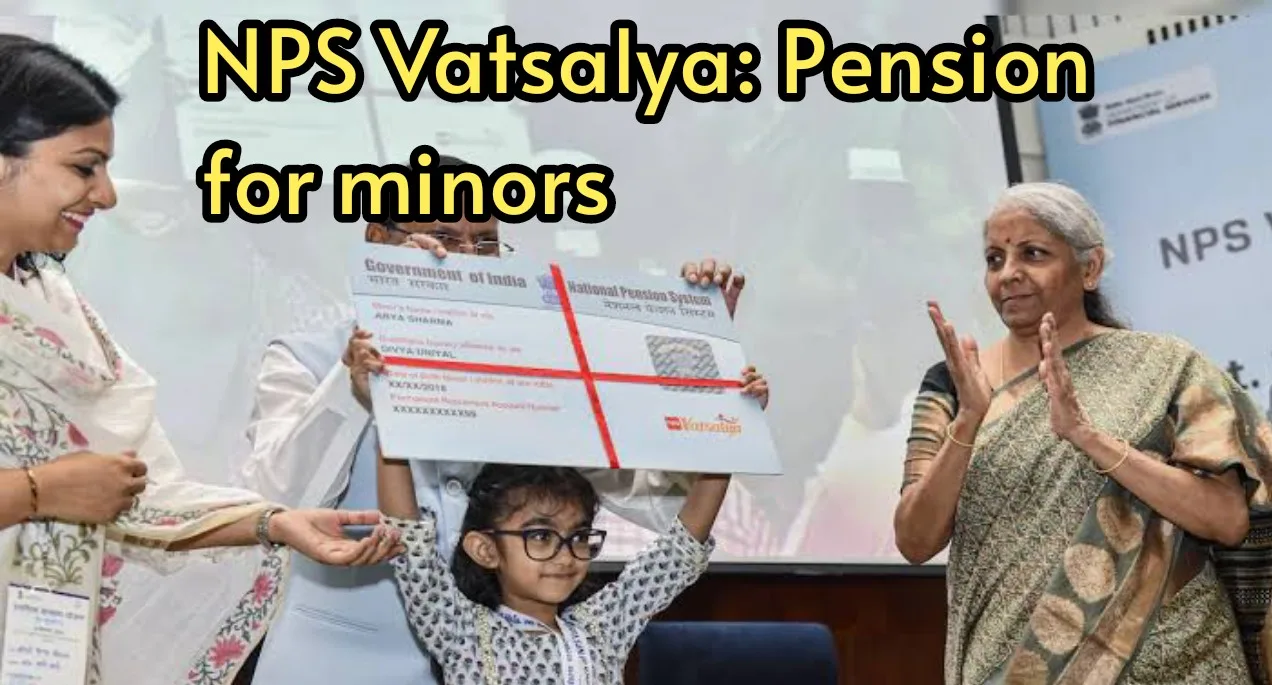

Did you know that the adults govt also gives pension to minors? Yes you’ve heard it right. The government introduces various schemes that allow you to invest and secure your future. One notable initiative is the ‘NPS Vatsalya’ scheme, which offers a new pension plan specifically for minor children. This was announced by Finance Minister Nirmala Sitharaman during the Union Budget in July 2024. The scheme has been launched in 75 locations nationwide, and over 250 Permanent Retirement Account Numbers (PRAN) have already been issued to children.

What is the NPS Vatsalya Scheme?

This scheme provides parents with a chance to save for their child’s future. You can open a pension account in your child’s name under this program. Investing in the NPS Vatsalya scheme is straightforward and offers a variety of flexible options. You can start with an investment of just Rs 1,000 per year. Accounts can be opened online or by visiting a bank or post office.

During the launch, Finance Minister Nirmala Sitharaman highlighted that this is a long-term investment plan for all citizens. The scheme aims to secure the future of its participants and is grounded in equity principles. Additionally, it offers protection for both the elderly and the youth in the family. The Finance Minister also pointed out that this initiative will encourage young people to develop saving habits, and thanks to compound interest, they will be able to accumulate a significant amount over time.

Calculation of NPS Vatsalya

If you want your kid to have Rs 1 crore by the time they hit 60, you can make that happen by putting away just Rs 275 each month or Rs 3,300 a year. Let’s break it down: if you invest Rs 275 monthly or Rs 3,300 yearly, your total investment over 60 years at a 10% interest rate will be Rs 1,98,000.

Now, when it comes to returns, if you keep investing that same amount, after 60 years at a 10% interest rate, you’ll end up with a whopping Rs 98,17,198 in returns. So, your total amount will be Rs 1,00,15,198.

Specialty of NPS Vatsalya

Here’s the cool part: any minor with a PAN card and Aadhar card, who’s under 18, can jump into this scheme. You can start investing with as little as Rs 1,000 a year. Parents or guardians can invest on behalf of their kids.

Once the minor turns 18, their NPS account will switch to a regular account after submitting the necessary KYC documents. Plus, after a 3-year lock-in period, you can withdraw up to 25% of the amount for things like education, serious illness, or disability.