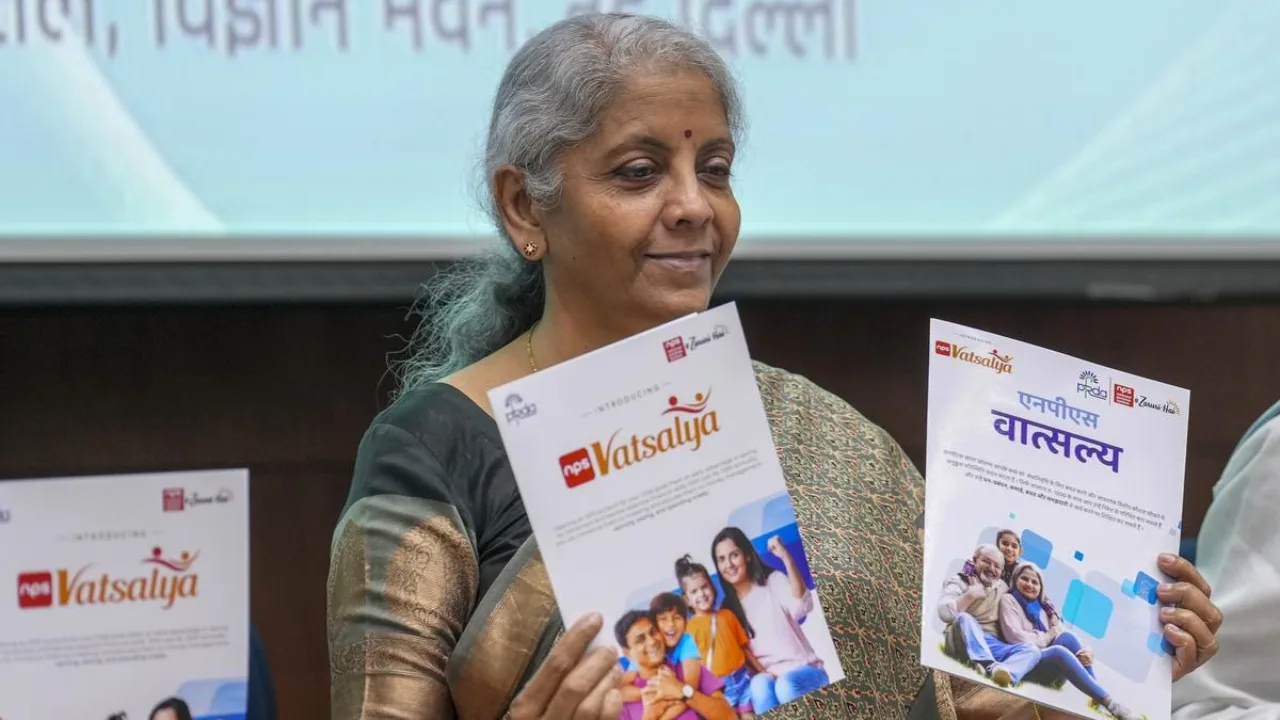

The Government of India has started the new NPS Vatsalya Yojana, worrying about the future of children and keeping in mind the pension facility for them. Under this scheme, the benefits of this scheme can be started for the children from their birth. Parents can give the benefits of this scheme to their children. In this scheme, parents can invest in the children until the child is 18 years old. This can be a good option to take children towards a secure future.

How much can be invested

The Government of India has started the NPS Vatsalya Yojana to provide pension facilities to children. There is no maximum limit under this scheme. This means that parents can invest as much as they want under this scheme.

On the other hand, if we talk about its minimum investment, then parents can invest up to a minimum of Rs 1000 in it. In this scheme, the government also provides the facility of partial withdrawal to the parents and the children get pension benefits from this scheme.

When the children turn 18 years old, the government gives the children a chance to handle this scheme for which it is converted into Tier 1. This scheme matures when the children turn 18 years old. If the child wants, he can take this scheme forward on his own through KYC. After the child turns 18, this scheme works like a regular NPS scheme.

If the investor wants, he can withdraw the entire money after 18 years, for this some rules can be followed. If there is less than Rs 2.5 lakh in the account, then the investor can withdraw the entire amount. If there is more than Rs 2.5 lakh in the account, then the investor is allowed to withdraw only 20%. The remaining money will be received in the form of a pension.

See NPS calculation

People often think about investing in NPS Vatsalya and how much interest they will get. If the investor invests Rs 1000 every year in this scheme, then he will have to invest Rs 2 lakh 16 thousand in 18 years. On this, the investor will get an annual return of 10%, which after 18 years you will get a return of Rs 379577. When the child turns 18, then you will get a benefit of more than 6 lakh rupees.

On the other hand, if you withdraw this amount after 60 years, then you will get a benefit of Rs 3 crore 83 lakh. On the other hand, if you take an annuity after 60 years, then you will get a return of 5 to 6% on it. This means that you get an interest of Rs 19-22 lakh annually and a benefit of Rs 1.5 lakh in the form of a pension.