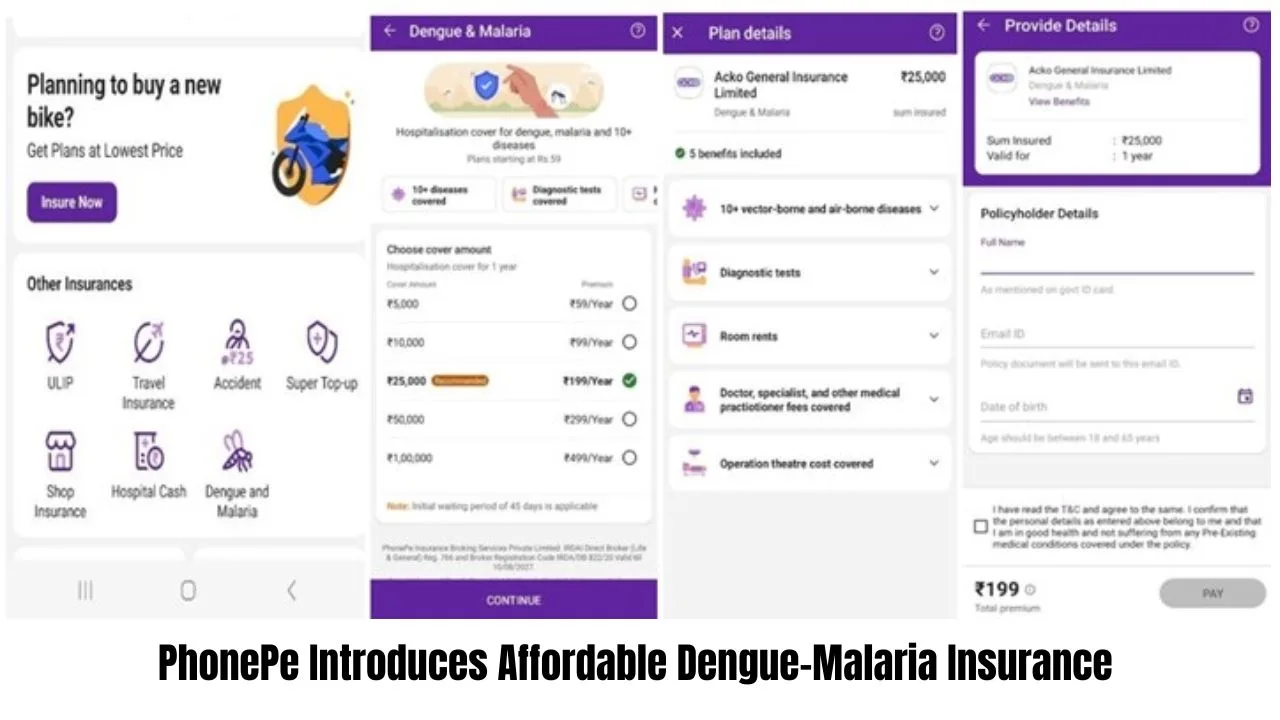

PhonePe, on Tuesday, launched an affordable insurance plan for dengue and malaria, starting at just ₹59 per year. This health insurance plan provides coverage of up to ₹1 lakh for dengue, malaria, and other air and mosquito-borne diseases. It is especially beneficial for people living in tier-2 and tier-3 cities, helping them avoid unexpected medical expenses throughout the year.

The plan covers over 10 diseases, such as malaria, dengue, chikungunya, filariasis, Japanese encephalitis, swine flu, bird flu, typhoid, pulmonary tuberculosis and meningitis. It also covers hospitalization, tests and ICU treatment expenses. Unlike other insurance plans, this plan is not limited to monsoons only. It provides year-round protection, allowing PhonePe users to avail of insurance at any time.

Instant and Hassle-Free Process

The plan can be purchased, managed, and claimed instantly on the PhonePe app. With a 100% digital process, claims are settled quickly and easily, offering convenience to users.

Additional Protection Beyond Corporate Insurance

Even users with existing corporate health insurance can opt for this plan for added coverage against mosquito-borne diseases.

Affordable and Accessible for All

Vishal Gupta, CEO of PhonePe Insurance Broking Services, emphasized the goal of making insurance accessible and affordable for everyone, providing year-round protection. PhonePe also aims to address health risks and financial constraints by offering insurance solutions tailored to the needs of Indians through digital platforms.