Everyone dreams of buying their own house, but purchasing a home is not an easy task. It requires lakhs of rupees to buy a house. For many people, their entire life’s earnings are not enough to afford a home. In such cases, taking a home loan from a bank is the best option. Nowadays, many people are opting for home loans to buy a house. If you are also planning to take a home loan, it’s important to understand the mathematics behind it.

Different banks in the country offer home loans to their customers at varying interest rates. Therefore, it’s important to choose the right bank before taking a home loan. Today, we will talk about the home loan offered by SBI, the country’s largest government bank. We will also explain the EMI calculation for a home loan taken from SBI. Let’s find out.

Home Loan from SBI

The country’s largest public sector bank, SBI, offers home loans to its customers at an initial interest rate of 8.25%. However, this rate may vary depending on your CIBIL score. If you are planning to take a home loan of ₹60 lakhs from SBI, it’s important to understand the monthly EMI calculation.

Home Loan of ₹60 Lakhs from SBI

If you take a ₹60 lakh home loan from SBI and have a good CIBIL score, you will receive the loan at an interest rate of 8.25%. For a loan term of 10 years, your monthly EMI will be ₹73,592. Over the 10 years, you will repay a total of ₹88,30,989 to the bank. This means you will pay ₹28,30,989 as interest on the ₹60 lakh home loan.

How to Take a Home Loan from SBI?

1. Check Eligibility:

Ensure you’re 18-70 years old, have a stable income, and a good CIBIL score (preferably above 750).

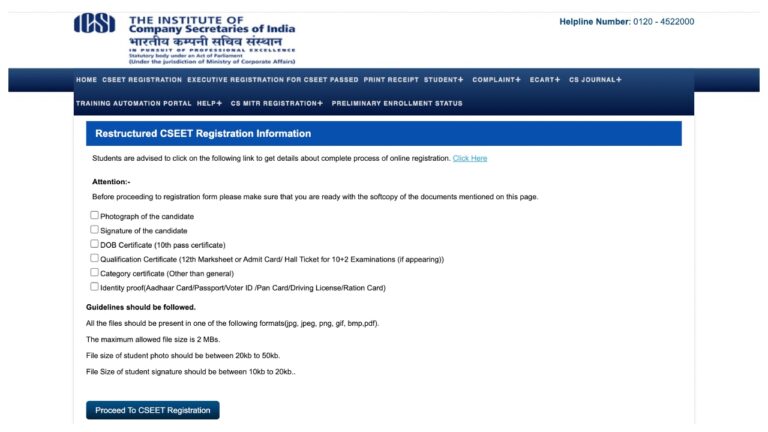

2. Gather Documents:

Prepare identity proof, address proof, income proof, property documents, and bank statements.

3. Choose Loan Amount and Tenure:

Decide how much you need and the loan term (up to 30 years).

4. Apply for Loan:

Apply online via SBI’s website or YONO app, or visit your nearest branch.

5. Pay Processing Fee:

A small fee (around 0.35% of the loan amount) is required to process your application.

6. Loan Approval:

SBI will verify your documents and creditworthiness. If all is good, your loan is approved.

7. Loan Disbursement:

The loan amount will be disbursed either to your account or directly to the seller.

8. Start Repaying EMIs:

Begin paying your EMIs as per the loan agreement.

Disclaimer: The information provided is for general guidance only and may vary based on individual eligibility, bank policies, and terms. Please check with SBI for the latest details and interest rates before applying. The bank holds the right to approve or reject loan applications as per its discretion.