Everyone should consider investing their savings in a bank or financial institution’s scheme. If you want to open an FD in your name or a family member’s name, there are several things you should keep in mind before proceeding. Through this article, let’s learn more about an FD plan from the country’s largest government bank, State Bank of India (SBI).

It is often believed that private banks or small finance banks do not offer high interest on FDs. However, this is not true. Customers can get a very good return on an FD with SBI, the largest public sector bank in the country. SBI offers a special investment scheme for senior citizens, which provides many benefits. This FD is called the ‘SBI WeCare Special FD’.

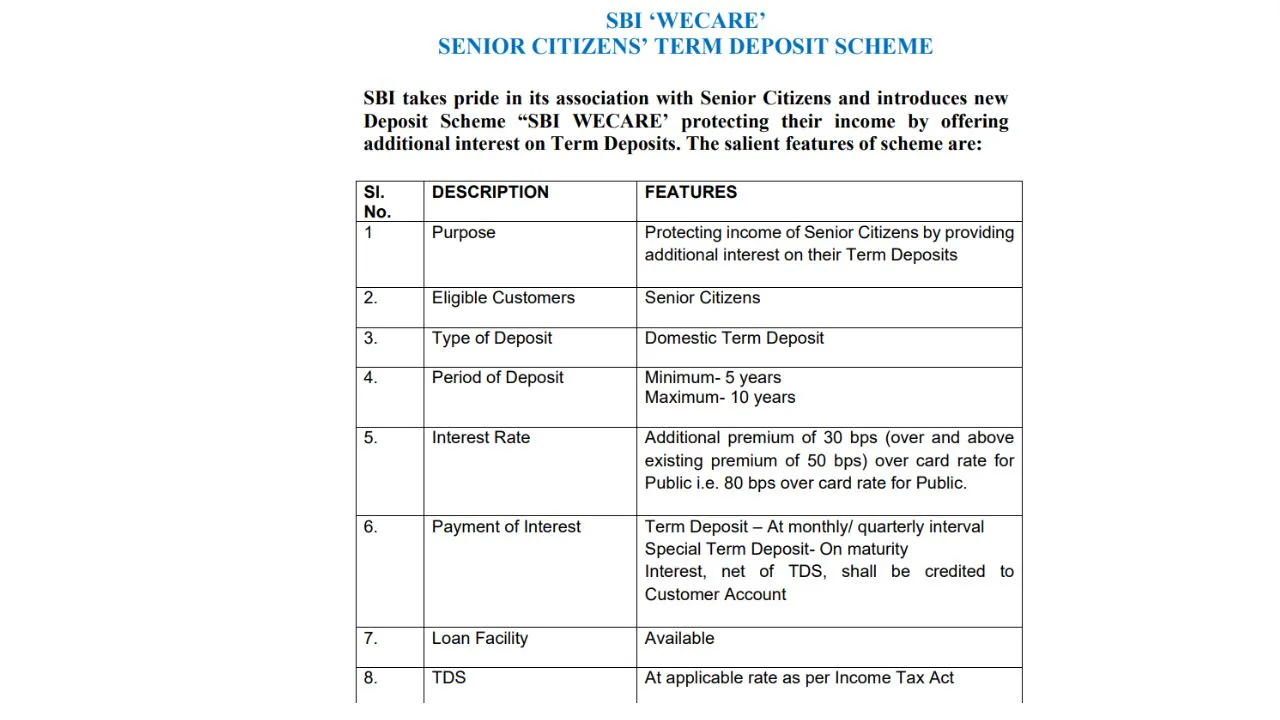

What is SBI We Care FD?

This FD was launched during the Corona pandemic. By investing in this scheme, your money has the potential to double. It is primarily designed for senior citizens, aiming to keep your funds safe while offering higher returns and more interest.

If you are planning to invest in this scheme, it is advisable to open the FD before September 30, 2023.

SBI We Care FD Interest Rate

Customers receive higher interest on the SBI We Care Fixed Deposit compared to other schemes. As per the SBI website, customers earn 7.50 percent interest on tenure of 5 to 10 years. Senior citizens receive an additional 0.50 percent interest. This FD can be opened through net banking, the YONO app, or by visiting the bank. TDS is deducted on this FD either monthly, quarterly, every 6 months, or annually.

For regular FD, customers receive interest ranging from 3.50 percent to 7.50 percent for tenures from 7 days to 10 years.

Benefits of SBI We Care FD

Investing in this scheme means your money can double after 10 years. For example, if you invested Rs 5 lakh in 2020 for 10 years at an interest rate of 6.5 percent, after 10 years, the bank would give you Rs 5 lakh as interest. In this way, your investment would double in 10 years.

SBI’s Amrit Kalash FD Scheme

The Amrit Kalash FD scheme, also offered by the State Bank of India, is another excellent option for senior citizens and other customers. This scheme offers high interest rates and has increased its tenure options, providing a great alternative to other FD schemes.