SBI Mutual Funds: The stock market has started recovering after a decline of about one and a half months. This long-term downturn in the market had a significant impact on mutual fund portfolios. However, some mutual fund schemes had already provided significant returns before the decline. While returns have certainly decreased, the effect has not been as severe. Today, we will tell you about one such SBI mutual fund scheme, which has delivered an impressive return of 49.89 per cent over the last year, despite this challenging market period.

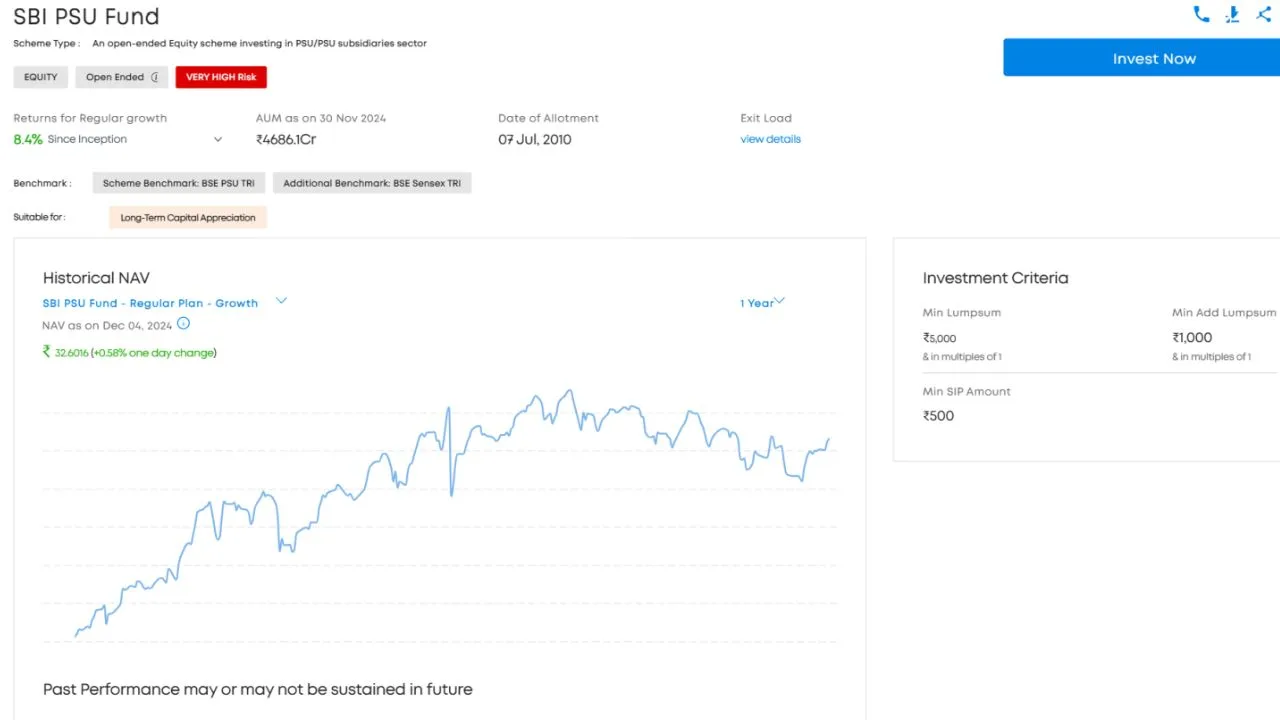

SBI PSU Fund’s Impressive Returns: 49.89% in 1 Year

According to AMFI data, the direct plan of the SBI PSU Fund has delivered a return of 49.89% in the last year. The regular plan has given a return of 48.20%. In comparison, the PSU Fund benchmark returned 50.42% during the same period. Over the last year, the entire PSU Funds category has provided returns of more than 40%, showcasing the strength of government-linked investments.

SBI PSU Fund’s Performance Over Time

- 1-Year Return: 49.89% (Direct Plan)

- 3-Year Return: 38.95%

- 5-Year Return: 26.86%

- 10-Year Return: 13.10%

- Since Launch: 8.61%

Top Companies in SBI PSU Fund’s Portfolio

SBI PSU Fund invests in shares of government companies like State Bank of India, Powergrid, GAIL, Bharat Electronics, Bharat Petroleum, NTPC, NMDC, Bank of Baroda, Petronet LNG, and General Insurance Corporation.

Long-Term Returns of SBI PSU Fund

In the last 3 years, the fund has given a return of 38.95%, 26.86% in the last 5 years, 13.10% over the last 10 years, and 8.61% since its launch.