SBI Har Ghar Lakhpati Scheme: State Bank of India’s Har Ghar Lakhpati Yojana is an excellent recurring deposit scheme designed to help individuals build a substantial corpus over time. While the scheme’s name suggests a focus on creating wealth up to a lakh, there is no barrier to reaching the millionaire mark with regular, thoughtful investments.

Under this scheme, you can invest a set amount each month, and the power of compounded interest can work in your favour. Additionally, you can choose to invest for multiple family members, maximizing your investment potential. Importantly, there is no upper limit on how much you can deposit, making it an ideal option for those looking to build significant wealth over time. In this article, we will provide a detailed breakdown of everything you need to know about this scheme.

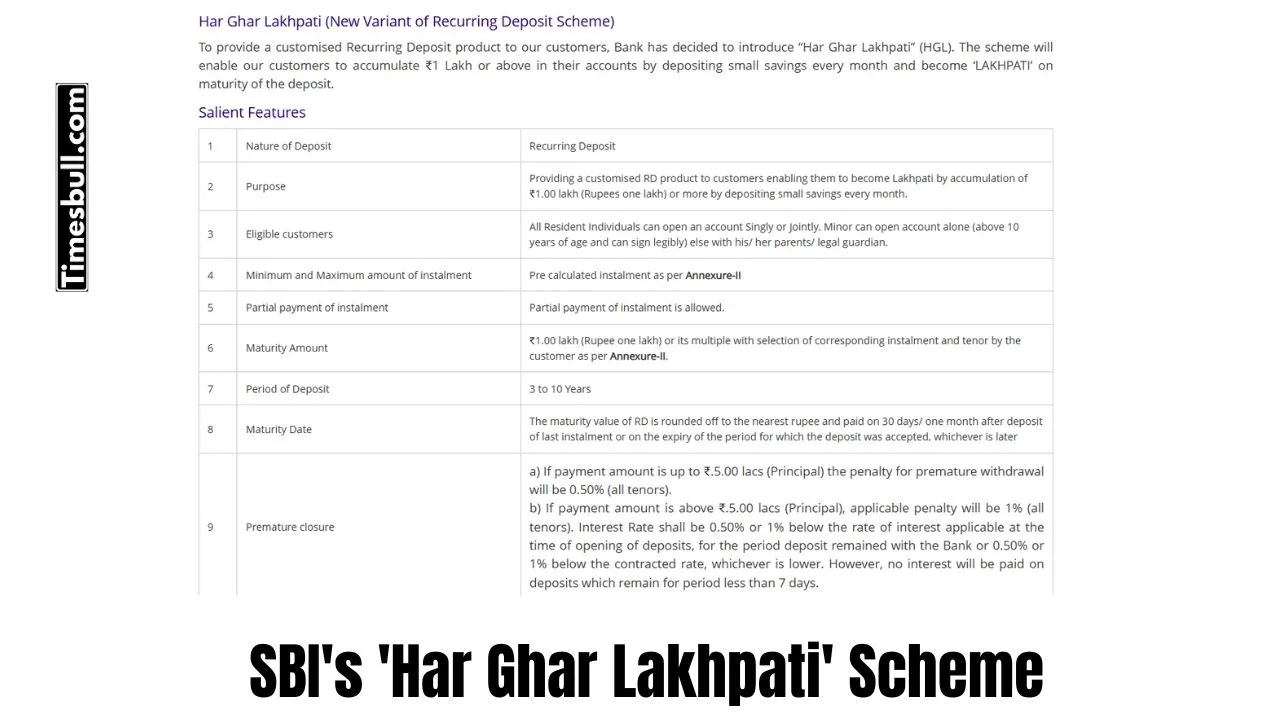

Penalty on Late Payments and Premature Withdrawals

Under SBI’s Har Ghar Lakhpati Yojana, a penalty will be imposed for late payments to maintain discipline in the investment process. Similarly, premature withdrawals will also be penalized. However, these penalties are designed to encourage financial discipline, considering the scheme offers a good rate of interest, guaranteed returns, and capital safety.

Interest Rates and Eligibility

The fixed deposit scheme, with a tenure of 3 to 10 years, offers an interest rate ranging from 6.75% to 7.25%. Individuals above 10 years of age are eligible to open an account. People aged between 10 and 60 years will earn an interest rate of 6.75%, while those over 60 years will receive 7.25% interest on their investments.

TDS on Interest Earnings

If the annual interest exceeds ₹40,000 under the Har Ghar Lakhpati Yojana, a 10% TDS will be deducted, as is the case with other fixed deposit schemes. For senior citizens, the TDS threshold is ₹50,000. Additionally, if you fail to deposit money for six consecutive months, your RD account will be closed, and the balance will be transferred to your savings account.

Premature Closure:

For principal up to ₹5 lakh: 0.50% penalty.

For principals above ₹5 lakh: 1% penalty.

Interest rate reduction based on tenure and applicable rates at the time of deposit.

No interest is paid for deposits held for less than 7 days.

Advance Payment of Installments:

Does not change maturity value.

Delayed payments attract penalties deducted from the maturity amount.

Tax Deduction: Applicable as per Income Tax Rules.

Penalty for Late Installments:

- ₹1.50 per ₹100 per month for RD tenure up to 5 years.

- ₹2.00 per ₹100 per month for RD tenure above 5 years.

- Penalty shall not exceed the interest earned on the deposit.