On New Year’s, banks are launching many new schemes to attract customers. In this series, the country’s largest bank, State Bank of India, has launched two new schemes: Har Ghar Lakhpati RD Yojana and SBI Patrons FD Yojana. Investors can earn good profits from both schemes. Har Ghar Lakhpati Yojana is a recurring deposit scheme, where an investor can accumulate up to Rs 1 lakh. Meanwhile, SBI Patrons is a fixed deposit scheme, specifically designed for senior citizens aged 80 and above. Let’s find out how to benefit from these schemes and how they work.

The aim of starting this scheme is to keep the bank’s leadership in the market. State Bank Chairman CS Shetty explained that the goal is to create financial products that not only provide good returns but also help customers achieve their dreams.

Helping the Lower Middle Class

State Bank of India introduced the Lakhpati scheme with the needs of lower-middle-class families in mind. The Har Ghar Lakhpati scheme allows customers to deposit one lakh rupees or its multiples within a fixed period. This scheme is very helpful for children, as parents often face difficulties in arranging money for education and other needs. Keeping this in mind, SBI created this RD scheme.

How the Scheme Works

In the Har Ghar Lakhpati scheme, you can deposit money for a period of 3 to 10 years. By saving a small amount each month, you can build up more than Rs 1 lakh. Currently, if you save Rs 591 every month, you can reach Rs 1 lakh in 10 years. Senior citizens can save Rs 574 per month and achieve the same amount in the same time.

Sapno ka safar shuru hota hai chhoti chhoti bachat se!

Har Ghar Lakhpati Recurring Deposit scheme ke saath, har mahine thoda bachaaiye aur apne lakhpati banne ka sapna sach kariye.

SBI ke saath #MeraFutureFixHai

To know more, visit https://t.co/PCryq3uUzN#SBI… pic.twitter.com/FxGeBt1pAc

— State Bank of India (@TheOfficialSBI) January 4, 2025

However, you will be charged a penalty if you miss a monthly deposit. For RDs with a tenure of five years or less, the penalty is Rs 9 per month. For RDs with a tenure of more than five years, the penalty is around Rs 12 per month. If you miss six consecutive payments, the bank will close your account and return the deposited money.

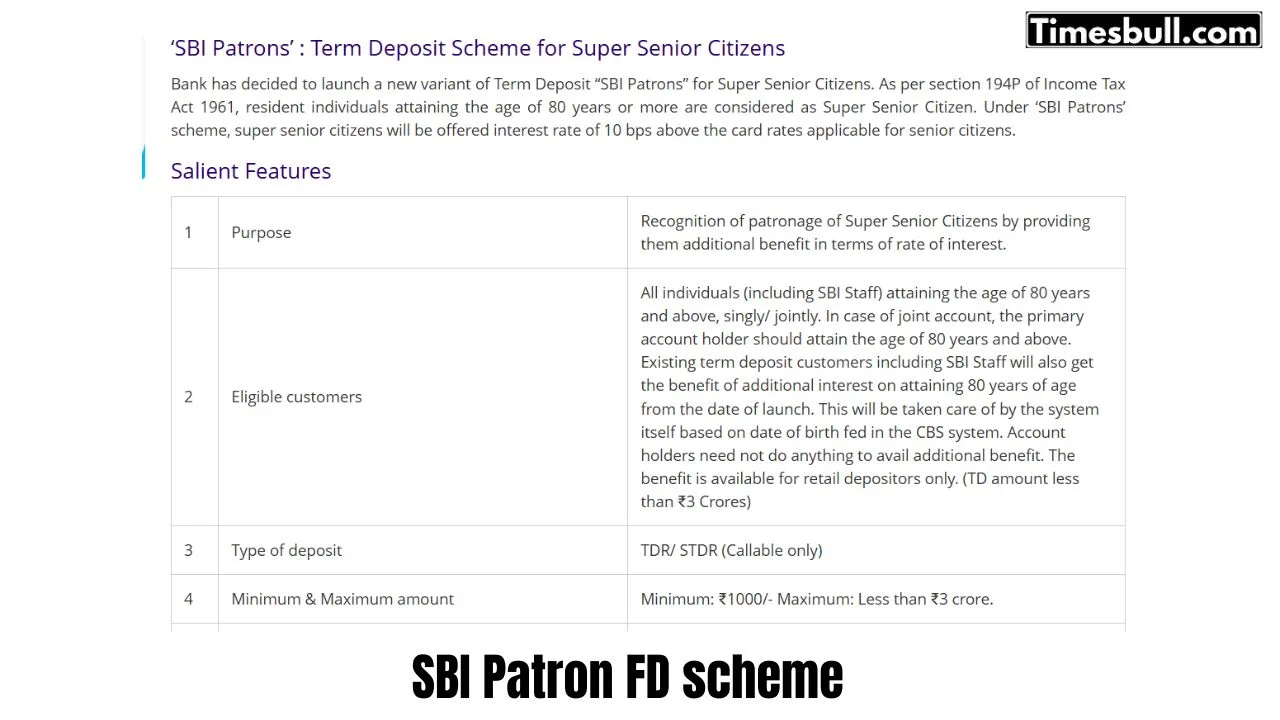

A Beneficial Scheme for Senior Citizens

SBI has also launched the Patron FD scheme for senior citizens aged 80 or older. This fixed deposit scheme is available for both new and old customers. You can deposit as little as Rs 1,000 or as much as Rs 3 crore. The deposit period can be from seven days to 10 years. However, there will be a penalty if you withdraw money before the maturity date.