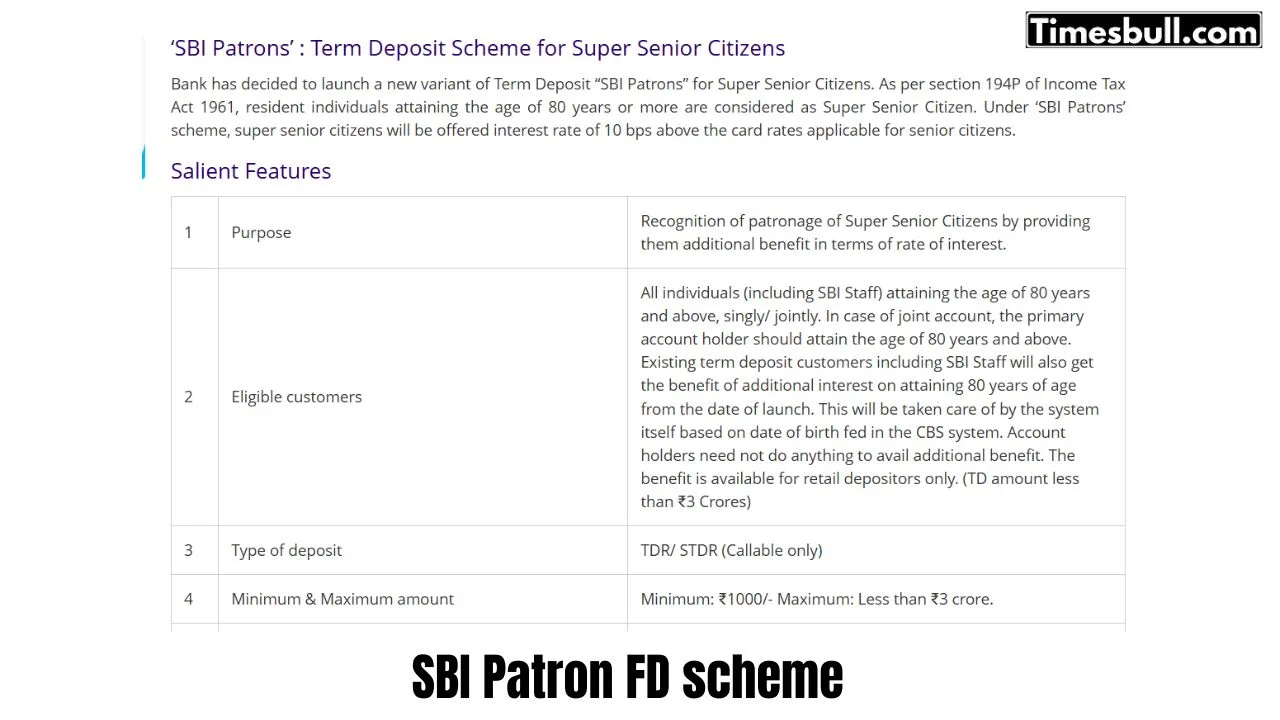

India’s largest public sector bank, SBI, has launched a special FD for super-senior citizens to strengthen their financial security. This FD, named the SBI Patron Fixed Deposit Scheme, is for senior citizens aged 80 years and above.

Under the SBI Patron FD scheme, super senior citizens receive an additional 10 basis points (0.10%) interest rate over the regular senior citizen rates. According to Amol Joshi, founder of Plan Rupee Investment Services, the 10 basis point increase in the interest rate is a welcome step, but its impact is relatively small. This means the interest rates for super senior citizens will range from 4.10% to 7.60%.

Invest with Rs 1,000

The minimum deposit amount for this scheme is Rs 1,000, while the maximum deposit limit is Rs 3 crore. The account can be operated singly or jointly, but for joint accounts, the primary account holder must be at least 80 years of age. The deposit period ranges from 7 days to 10 years. This allows you to invest a small amount for a short time.

Who said retirement means slowing down?

SBI Patrons helps you stay ahead of the curve with competitive interest rates on Term deposits.

Visit https://t.co/5lxlYAA48V for more information!#SBI #TheBankerToEveryIndian #TermDeposit #SuperSeniorCitizens pic.twitter.com/km9e7PQaTc

— State Bank of India (@TheOfficialSBI) February 3, 2025

Highest Interest in How Much Time?

SBI also offers several other FD schemes for senior citizens, including super senior citizens. The SBI V-Care Deposit Scheme provides a 7.6% interest rate on a one-year FD and 7.9% on a two-year FD. This return is higher than the SBI Patrons FD scheme. Additionally, SBI offers special short-term FD schemes like the 444-day Amrit Vrishti (7.75% interest rate) and 400-day Amrit Kalash (7.6% interest rate), which also provide higher interest rates than the SBI Patrons scheme.

Other Banks Offer Good Returns

According to Lieutenant Colonel Rochak Bakshi (retired), founder of Pune-based financial and investment planning firm True North Finance, some banks, like Bank of Baroda and HDFC Bank, offer high interest rates of 7.5% for five years for super senior citizens. Kotak Mahindra Bank offers 7.6%. In comparison, SBI offers a relatively low interest rate of 7.35% for a five-year term.