Bank Deposit Insurance: Recently, when the New India Co-operative Bank scam came to light, news came that the government may soon decide to increase the insurance coverage on bank deposits. Under the current system, bank deposits get cover of up to ₹ 5 lakh.

If the government does this, crores of bank customers will get relief, but it may also increase the problems of banks. Now a report has come in this regard, which has raised the question of whether the government can change its mind. This issue is important for millions of bank customers, who are worried about the safety of their deposits.

How much will it affect

Rating agency ICRA says that increasing the limit of insurance coverage on bank deposits is likely to affect the profits of banks. According to the agency, if the insurance coverage is increased, it may reduce the profits of banks by up to ₹ 12 thousand crores. ICRA says that as of March 2024, 97.8 percent of bank accounts were fully covered, as the deposits in them were within the limit of ₹ 5 lakh.

In terms of the value of deposits, the insured deposit ratio (IDR) was 43.1 percent as of March 31, 2024. A change in this IDR adversely affects the profits of banks as they have to pay more money as a premium. This is an important economic aspect that affects both banks and customers.

Insurance covers up to ₹ 5 lakh, know the whole process

Under the current system, when a bank sinks, the account holders get insurance up to ₹ 5 lakh under the Deposit Insurance and Credit Guarantee Corporation Act (DICGC). For this, the account holder has to submit a claim, the insurance amount is given to the eligible customers.

In this situation, those who have more than ₹ 5 lakh in their account suffer huge losses. DICGC collects premiums from banks to provide insurance coverage to customers in case of a bank sinking. It is a safety shield that protects customers from bank failures.

Will it get approval this time

After the New India Co-operative Bank scam came to light, Department of Financial Services Secretary M Nagaraju said that the proposal to increase the insurance cover is under consideration. Its notification will be issued as soon as the government approves it. By the way, this demand has been raised earlier as well. But no decision could be taken on this.

Now after the bank scam that has come to light, this demand has gained momentum again. However, it will be interesting to see if the government approves it even keeping in mind the losses to the banks. This is a complex decision in which both financial stability and customer protection have to be balanced.

When was the increase done earlier

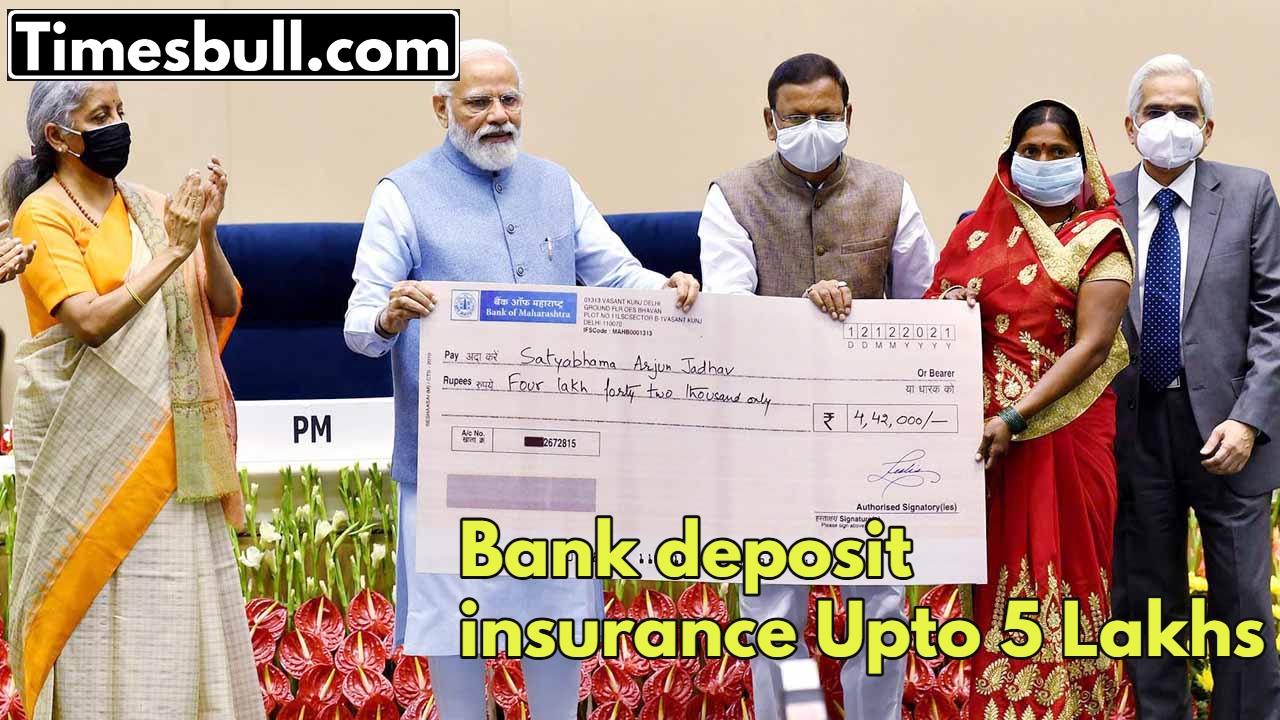

The insurance limit of DICGC was last increased in 2020. This happened after the PMC Bank scam came to light. Then this limit was increased from ₹ 1 lakh to ₹ 5 lakh. The scam of Punjab and Maharashtra Co-operative Bank (PMC) came to light in September 2019.

RBI found out that PMC Bank was using fake bank accounts to lend around ₹6500 crore to a real estate developer in Mumbai. Following this, RBI imposed a limit on withdrawals from the bank. This was a landmark event that prompted reforms in the banking sector.