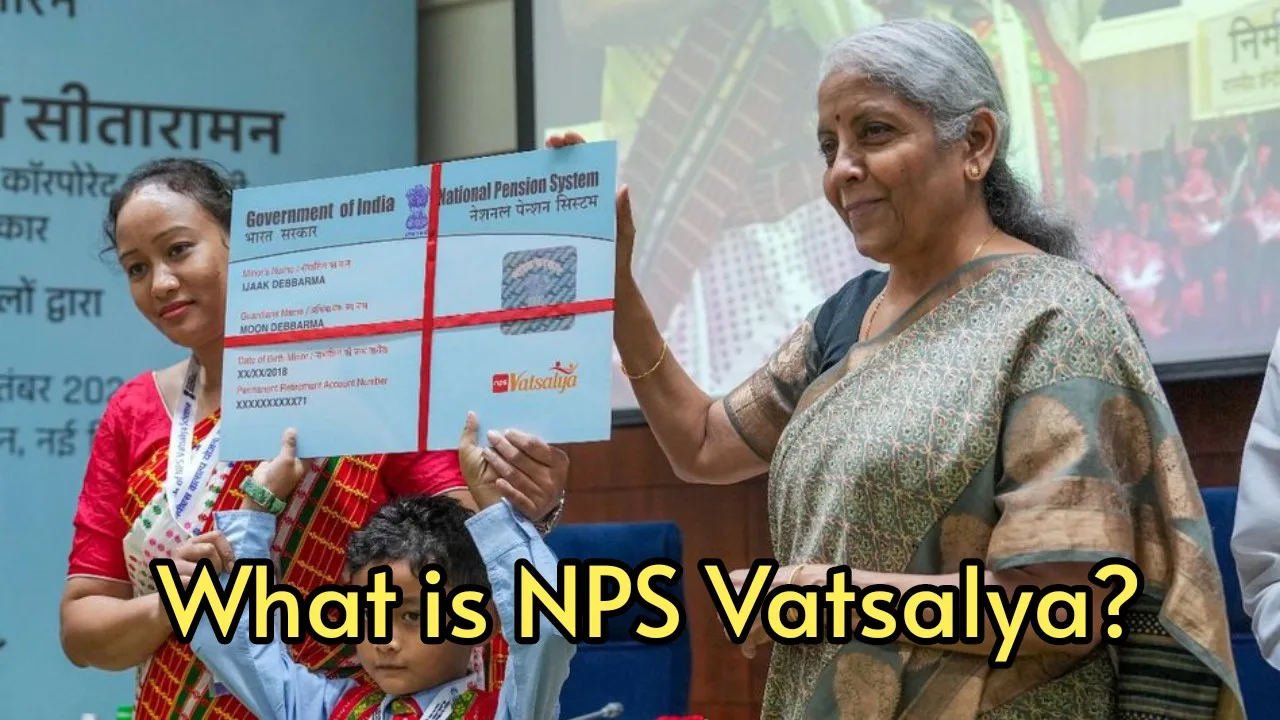

Big update revealed regarding NPS Vatsalya. The NPS Vatsalya scheme launched under the National Pension Scheme (NPS) has received a strong response. The newly introduced NPS Vatsalya initiative aimed at securing the future of minors is showing promising results. Since its inception in September, the scheme has attracted 75,000 participants. Finance Minister Nirmala Sitharaman officially launched the NPS Vatsalya program in September.

Eligibility Criteria

1. All individuals under the age of 18.

2. Accounts can be established in the name of a minor and managed by a parent or guardian, with the minor designated as the beneficiary.

3. The scheme can be accessed through various Point of Presence (PoP) platforms overseen by the PFRDA, including major banks, India Post, Pension Funds, and the Online Platform (eNPS).

Contribution Details

Participants in the NPS Vatsalya scheme are required to contribute a minimum of Rs 1,000 annually, with no upper limit on contributions. Subscribers have the option to invest in government securities, corporate debt, and equities in different proportions based on their risk tolerance and anticipated returns.

Additionally, Pension Fund Regulatory Development Authority Chairman Deepak Mohanty indicated on Saturday that the assets under management (AUM) for the National Pension System (NPS) are projected to reach Rs 15 lakh crore by the conclusion of the current financial year (2024-25).

1.6 Crore Subscribers

Currently, the total number of subscribers in the pension sector exceeds eight crore, which includes 6.4 crore participants in the Atal Pension Yojana. Of this, the NPS accounts for approximately 1.6 crore subscribers. The contributions made to the pension system amount to around Rs 14 lakh crore, and it is anticipated that this figure will rise to Rs 15 lakh crore by the end of the year.

Desclimer : For any financial invest anywhere on your own responsibility, Times Bull will not be responsible for it.