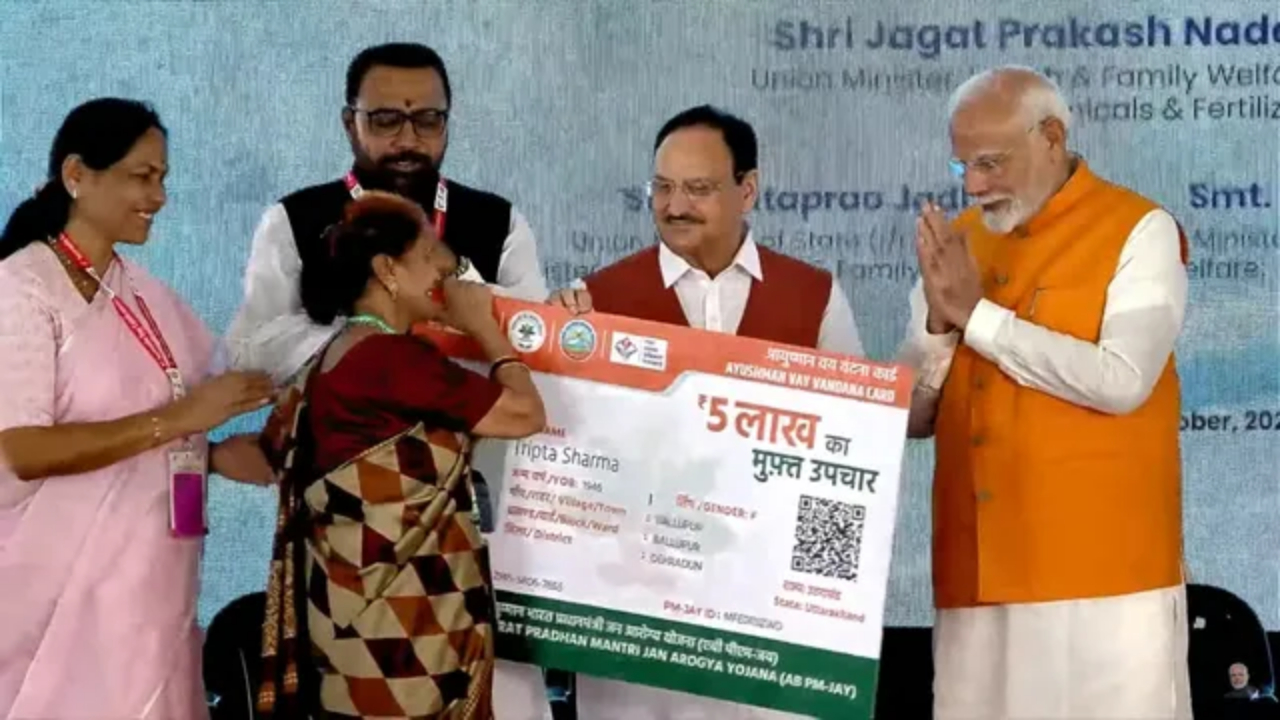

Ayushman Card: The Government of India launched the Pradhan Mantri Ayushman Bharat Yojana in the year 2018. The aim of this scheme is to provide free treatment to such people who are financially weak. Because not every person can get insurance to avoid medical expenses.

If an accident happens to a person, then all his savings are spent on treatment. To reduce the burden of these expenses, the government started the Ayushman Yojana. How to get free treatment if the Ayushman card is lost? By the way, the beneficiary can get free treatment only by showing the Ayushman card. Treatment can be availed in select hospitals only through Ayushman card. Through the card, you can avail free treatment up to Rs 5 lakh. But even if your Ayushman card is lost or broken, you can still avail free treatment.

Avail benefits like this

1. For this you have to go to the Ayushman Mitra help desk of the hospital. After which inform them about the card being lost or broken. You will have to tell your registered mobile number to the current operator.

2. Registered means the mobile number which is linked to your Ayushman card. The operator will identify you through this mobile number. After which you will be able to get free treatment without a card.

3. If the operator does not help you, then you can also lodge a complaint on the helpline number 14555 of Ayushman Yojana.

How to make Ayushman Card?

If you have not yet applied for Ayushman Card, then follow the steps given below carefully.

Step 1- First of all you have to go to any nearest CSC center.

Step 2- Here you have to check your eligibility by meeting the existing desk operator.

Step 3- After the eligibility is checked, the documents will be verified.

Step 4- After the application is submitted, you can download the card after some time.

Who cannot make Ayushman Card?

Ayushman Card is specially designed for poor people. Therefore, those people who work in the organized sector or those who pay their taxes on time will not be able to take advantage of this card. Along with this, even if you take advantage of ESIS or PF is deducted from your salary, you will not be able to avail the benefits of the scheme. Along with this, even if you have a government job or are financially capable, you are not eligible for this scheme.